Are Institutional Investors Selling Marathon Oil Stock?

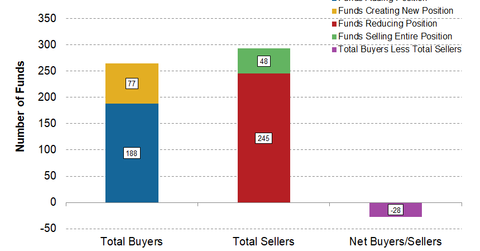

In Q1 2018, 265 funds were “buyers” of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions.

July 24 2018, Updated 10:31 a.m. ET

13F filing statistics for Marathon Oil

In Q1 2018, 265 funds were buyers of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions. In the same quarter, 293 funds were sellers, either closing their entire positions or reducing their existing positions. That means that in Q1 2018, total selling funds outnumbered buying funds by 28.

As of March 31, 625 funds that filed a Form 13F held MRO in their portfolios. Of those, six funds had MRO in their top ten holdings.

Even if we look at it from an aggregate number of shares point of view, for Q1 2018, 13F filing funds decreased their aggregate MRO holdings 3.07%, or from 691.25 million shares to 670.06 million shares. In terms of the number of common shares outstanding, 13F filing funds decreased their MRO holdings from ~81% of common shares outstanding to ~79% of common shares outstanding.

As of March 31, Marathon Oil had ~853 million common shares outstanding.

For context, in 1Q18, 13F filing funds decreased their aggregate holdings in Murphy Oil (MUR), Occidental Petroleum (OXY), Devon Energy (DVN) and Energen (EGN) by ~1.47%, ~2.60%, ~0.02%, and ~0.33%, respectively.

Form 13F is an SEC[1. U.S. Securities and Exchange Commission] mandate, which needs to be submitted by all funds that manage more than $100 million in assets. Form 13F is due 45 days after the end of each quarter. The funds have access to in-depth research and greater capital. Typically, when institutional investors buy a stock, there’s a chance that the stock could do well.