S&P 500’s Top Losses: Why Biogen Declined

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18.

Dec. 4 2020, Updated 10:53 a.m. ET

Top losses

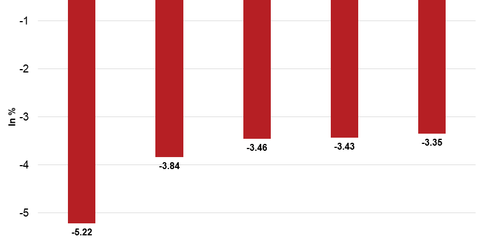

The S&P 500’s top losses on June 18 were:

Biogen

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18. After gaining for four consecutive trading weeks, Biogen opened lower on Monday and declined to three-week low price levels.

Market sentiment

The selling pressure in Biogen increased on June 18 amid a competitive threat from PTC Therapeutics (PTCT) and Novartis (NVS). Spinraza is an FDA-approved treatment from Biogen. Spinraza is used to treat spinal muscular atrophy. Currently, Spinraza is the top pick for spinal muscular atrophy. The sales reached $1 billion in 2017. However, PTC Therapeutics announced favorable data for treating spinal muscular atrophy with its drug “RG7916.” According to management, in a treatment that was conducted for 182 days, 90% of the babies suffering from Type 1 spinal muscular atrophy demonstrated an improvement. The data dented the market sentiment on Biogen and boosted PTC Therapeutics’ stock price as much as 41% on Monday.

Biogen is also facing competition from Novartis (NVS). Novartis acquired AveXis, which is working on gene therapy to treat spinal muscular atrophy. On June 18, PTC Therapeutics rose 27.5% and closed the day at $47.88—the highest daily close in three years. PTC Therapeutics is part of the NASDAQ Biotechnology (NBI) Index, which declined 0.75% on Monday. Biogen declined 5.2% on June 18 and closed the day at $289.12. Biogen is part of the S&P 500 healthcare sector, which declined 0.99% on Monday.

Next, we’ll discuss how the US Dollar Index and Treasury yields performed in the early hours on June 19.