PTC Therapeutics Inc

Latest PTC Therapeutics Inc News and Updates

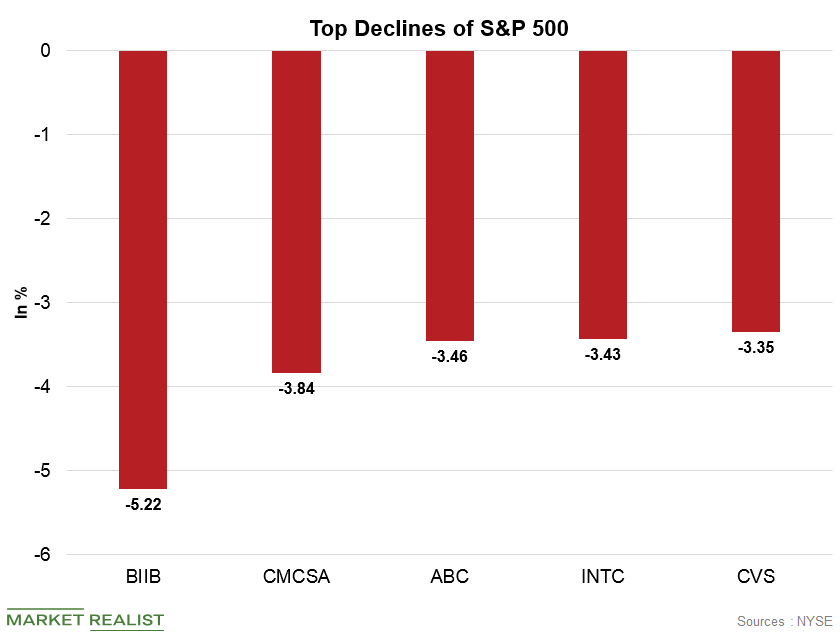

S&P 500’s Top Losses: Why Biogen Declined

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18.

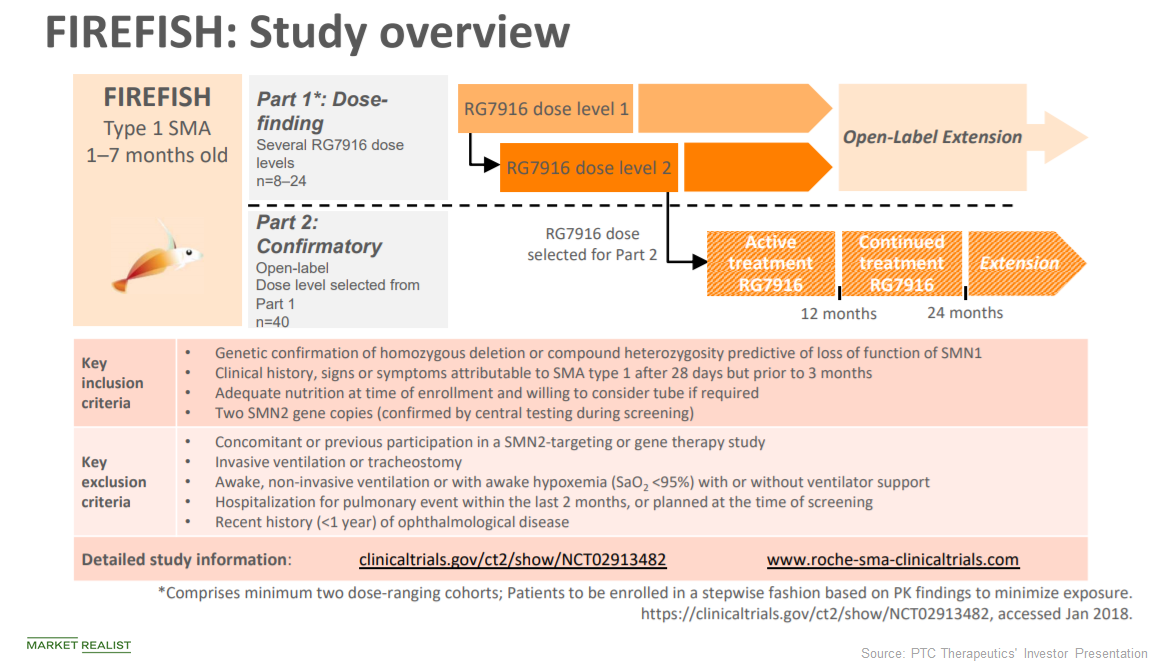

Risdiplam: Could It Be PTC Therapeutics’ Future Growth Driver?

In June, PTC Therapeutics (PTCT) presented its updated interim clinical data from the Phase 1 FIREFISH trial.

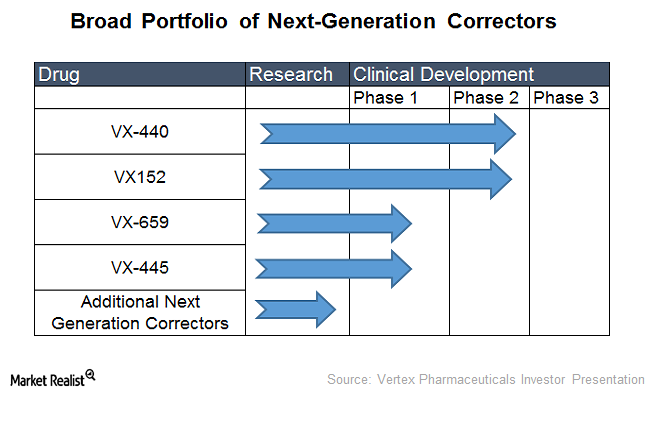

Inside Vertex Pharmaceuticals’ Clinical Pipeline

In March 2017, Vertex Pharmaceuticals (VRTX) announced promising results from two phase-3 clinical trials, Evolve and Expand.