Light Sweet Crude Oil Drives US Crude Oil Production Growth

According to the EIA (U.S. Energy Information Administration), recent growth in US crude oil production has been driven primarily by light, sweet crude oil.

June 18 2018, Published 1:42 p.m. ET

Light, sweet crude oil drives growth

According to the EIA (U.S. Energy Information Administration), recent growth in US crude oil production has been driven primarily by light, sweet crude oil, which is produced from tight resource formations such as the Permian, Eagle Ford, and Bakken Shales. Light, sweet crude oil accounted for almost 90% of the 3.1-million-barrel-per-day production growth that occurred between 2010 and 2017.

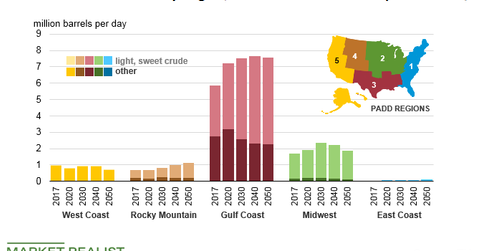

In 2017, light, sweet crude oil accounted for 56% of total domestic crude oil production, and in the EIA’s Annual Energy Outlook 2018, we can see that this is expected to grow to 60% by 2020 and to 70% by 2050.

The EIA expects that more than 80% of US crude oil production will occur in the Gulf Coast or US PADD 3 region, which houses the likes of the Permian and the Eagle Ford Shales, and the Midwest or US PADD 2 region (Bakken) from 2017 through 2050. Much of the growth in light, sweet crude oil production is expected to come in from the Gulf Coast, with production expected to increase from 3.1 million barrels per day in 2017 to 5.3 million barrels per day in 2050.

Key Gulf Coast and Midwest producers

Key players in the Permian include Concho Resources (CXO) and Parsley Energy (PE), which are pure-play Permian players. A significant Bakken player is Whiting Petroleum (WLL), with 81% of its Q1 2018 production coming from the Bakken. Murphy Oil (MUR) is a key Eagle Ford player. Around 47% of the company’s total North American onshore production in Q1 2018 came from the Eagle Ford shale.

Sensitivity cases for tight oil

In the outlook report’s “High Oil and Gas Resource and Technology” case, tight oil production is higher than the reference case, and light, sweet crude oil is expected to account for a greater share of domestic crude oil production, reaching 76% of the total in 2050.

In the “Low Oil and Gas Resource and Technology” case, the growth in tight oil production is lower than in the reference case, but light, sweet crude oil is still expected to account for 56% of domestic crude oil production in 2050.

In the following article, we’ll read about what’s been contributing to the increase in light tight oil in the United States.