Key Support and Resistance Levels in Tesla Stock This Week

Last week, Tesla stock (TSLA) continued to rise, gaining 12% and closing at $358.17 despite mixed market sentiment.

Nov. 20 2020, Updated 12:10 p.m. ET

Tesla stock

Last week, Tesla stock (TSLA) continued to rise, gaining 12% and closing at $358.17 despite mixed market sentiment. The week was its fourth in a row of upward movement.

TSLA ended the first quarter in negative territory, falling 14.5%, while auto peers (XLY) General Motors (GM), Ford (F), and Harley-Davidson (HOG) fell 11.3%, 10.3%, and 15.7%, respectively. Tesla began Q2 with optimism, rising 10.4% in April after falling 22.4% in March.

Key technical levels

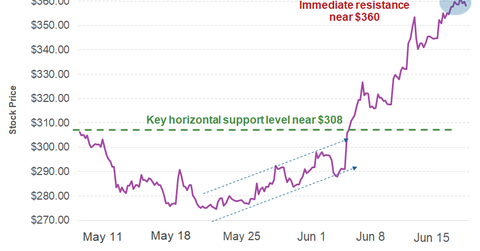

As of June 15, Tesla stock has been the top gainer among auto stocks quarter-to-date, rising 34.6%. On June 6, TSLA stock violated a downward resistance level, confirming bullishness. Its 50-day simple moving average was $298.36, well below its stock price, suggesting price strength.

Its 14-day RSI (relative strength index) score was within overbought territory, at 75.5, reflecting strength in the stock’s momentum. Its immediate horizontal resistance was near $360, followed by a key resistance at $389.61, its all-time high.

Eyes on Model 3 production

On June 5, Tesla CEO Elon Musk suggested that the company is likely to achieve its Model 3 production target of 5,000 unitsTesla’s Annual Report: Model 3, Supercharger, and Gigafactory per week by the end of the second quarter, prompting TSLA stock to rally 10% on June 6. However, Musk’s comment didn’t convince popular analysts such as Morgan Stanley’s Adam Jonas, who still thinks the company is likely to miss its production targets in the second quarter.

Investors should stay focused on TSLA’s Q2 vehicle production and delivery figures, which are expected to be released in the first week of July. Read achieve its Model 3 production target of 5,000 unitsTesla’s Annual Report: Model 3, Supercharger, and Gigafactory for more updates on Tesla. In the next part, we’ll learn how Ferrari stock traded last week.