What Are Nabors Industries’ Management Views for 2016?

Nabors Industries’ management expects high performance rigs to perform better when the energy market recovery starts.

June 8 2016, Published 4:25 p.m. ET

What does Nabors Industries’ CEO think?

Nabors Industries’ (NBR) management expects the crude oil market to start recovering in 2017. The recovery is expected to benefit high performance rigs first. In the company’s fiscal 1Q16 earnings conference call, its chairman and CEO (chief executive officer) Anthony Petrello said, “Signs of an emerging supply demand balance in the oil market are beginning to emerge. While we do not see tangible evidence of recovery in activity, we are beginning to collect anecdotes, which could point to a recovery late this year going into 2017.”

Petrello went on to say, “We believe the recovery will be modest initially, and could accelerate as commodity markets rebalance. We expect demand for high-performance rigs to increase at first, and for pricing in that segment to react accordingly.”

Nabors Industries expects lower margin pricing pressure

Nabors Industries’ management expects high performance rigs to perform better when the energy market recovery starts. Petrello said, “We expect demand for high-performance rigs to increase at first, and for pricing in that segment to react accordingly. As well, we would expect the restoration of temporary pricing concessions agreed to, with our international customers.”

Analyst targets for Nabors Industries

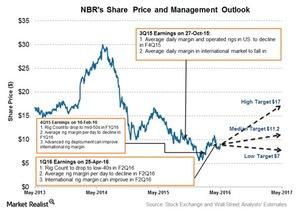

The lowest analyst target price for Nabors Industries is $7. The highest is $17. The median target price for NBR, surveyed among the sell-side analysts, is $11.20. Nabors Industries is currently trading near $10.80, implying a 4% upside at its median price.

Carbo Ceramics (CRR) received a $13.50 median target price. Compared to its current price of $14.10, this implies a nearly 3% downside. NBR is 0.03% of the iShares Core US Value (IUSV).

Next, we’ll take a look at Nabors Industries’ revenue and earnings.