Could Energy Continue Its Wild Ride in 2018?

From the presidential election in November 2016 through August 2017, the energy sector saw its worst time.

Feb. 28 2018, Updated 4:16 p.m. ET

Oil, oil everywhere in the USA (but please don’t drink it)

Energy has been on a wild ride since President Trump’s inauguration, having somewhat to do with the administration and somewhat not. The first six months were rough, with energy sliding almost 20% at one point in August, only to be followed by a massive, almost 30% rally before the recent pull-back. Net-net, energy is closer to flat, down 8% on the Level 1 S&P500 GICS. A lot of the down ride came just from an oversupply globally of crude oil. The rally then came from OPEC trying to hold supply and getting Russia to do the same.

But what has the administration done to help or hurt the situation? Well, it has definitely been helping producers by opening up drilling off vs. coasts, approving the Keystone pipeline, and generally weakening regulations in the United States that help with more drilling and fracking. Obviously, this is good news for producers and pipelines, but the abundance of oil in the United States (we hit over 10 million barrels per day recently—the first time since the early ‘70s) keeps a lid on prices.

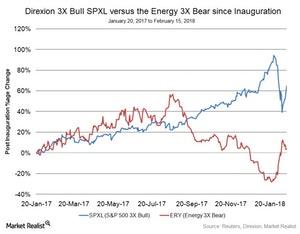

The good news for traders is the resulting price volatility. It’s hard to see this administration cracking down on drilling or regulations, given its general disregard for the natural environment, which should keep oil flowing. But OPEC still has an outsized grip on what happens globally with prices. Either way, Direxion can keep you in (or out of) the black gold with ERX (3x Bull) or ERY (3x Bear) Energy. Take a look at how ERY was a good hedge against the overall market early last year.

Market Realist

Energy saw its worst and then bounced back last year

From the presidential election in November 2016 through August 2017, the energy sector saw its worst time. Overproduction of crude oil and higher oil inventories weighed on oil prices, affecting the earnings of energy companies.

However, to limit crude oil production, OPEC (Organization of the Petroleum Exporting Countries) extended its previously announced production cuts. Global economic growth also boosted demand for crude oil. Crude oil prices benefited and started rising in 2017. President Donald Trump’s contribution to the energy sector included opening up public lands for oil and gas drilling, even offshore, withdrawing some environmental regulations and encouraging and signing tax reform legislation. He also proposed to support coal-fired power plants that are not financially feasible and cut climate change programs. Some of his proposals such as imposing tariffs on imports of solar panels have adversely affected solar power companies. The energy sector (XLE) rose 39% in 2017.

Outlook for 2018

In its October forecast report, the World Bank projected oil prices to increase an average of $56 per barrel in 2018 led by production cuts, strong global demand, and stabilizing US oil production. Among other energy commodities, natural gas and coal are expected to rise 4% in 2018.

After rising as much as 39% last year, the energy sector has fallen so far in 2018. The chart above shows the performance of the energy sector and industry performance YTD (year-to-date) in 2018. As of February 21, 2018, the energy sector has fallen 8.2% YTD.

As President Trump’s infrastructure proposals take effect, the demand for energy could rise in the United States. US and global economic growth and discipline among oil producers could raise oil prices in 2018. That could boost the earnings of energy companies such as Chevron (CVX), Schlumberger (SLB), and ExxonMobil (XOM).

Other factors could also influence oil prices. They include geopolitical and economic events, economic growth, and unplanned supply disruptions. Investors can opt to invest in the Direxion Daily Energy Bull 3X ETF (ERX) and the Direxion Daily Energy Bear 3X ETF (ERY).