Is Higher Inflation Hurting the Consumer Staples Sector?

The consumer staples sector is an important sector in the S&P 500 Index (SPY).

May 4 2018, Published 8:08 a.m. ET

Consumer staples sector in April

The consumer staples sector is an important sector in the S&P 500 Index (SPY). It is also an important sector for investors due to its defensive nature. The Consumer Staples Select Sector SPDR ETF (XLP), which tracks the performance of the consumer staples sector, fell 4.1% in April 2018, while the broader market S&P 500 Index (SPY) rose 0.28%.

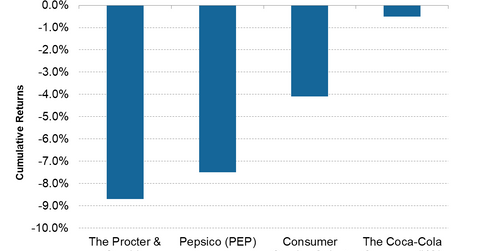

Investors generally invest in the consumer staples sector when uncertainty rises in the overall equity market. The consumer staples sector includes businesses such as food, household items, beverages, and tobacco. Procter & Gamble (PG), PepsiCo (PEP), and Coca-Cola (KO), major holdings of the XLP ETF, fell 8.7%, 7.5%, and 0.5%, respectively, in April.

Import tariff and consumer staples sector

President Donald Trump’s import tariffs on Chinese goods affected the movement of major consumer staples stocks in March 2018. China also announced that it will impose retaliatory tariffs on some US products. As a result, consumer staples stocks that earn a major portion of their revenues from China fell significantly.

Inflation

Now, rising inflation has been playing an important role in market movement. The recent rise in commodity prices could further increase inflation. Consumer staples companies aim to reduce commodity costs by buying larger quantities. However, in an inflationary environment, it will likely be difficult for companies to reduce their costs and increase their profit margins.