Factors that Could Drive Trulicity’s Revenue Growth in 2018

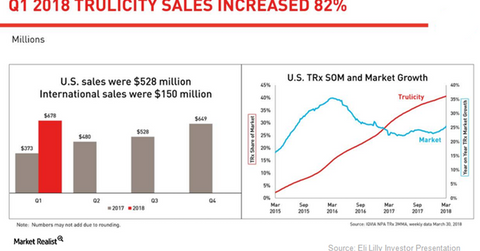

In 1Q18, Trulicity reported $678.3 million in revenues for YoY growth of ~82.0%.

May 3 2018, Updated 7:31 a.m. ET

GLP-1 class of drugs

Eli Lilly (LLY) is focused on creating awareness about its glucagon-like peptide-1 (or GLP-1) receptor agonist, Trulicity, among physicians to ensure they consider the latest medical information before prescribing to their patients. Despite the robust clinical profile of the GLP-1 class of drugs, the rate of adoption of new drugs in the diabetes segment is generally lower than that witnessed in the oncology segment.

This trend is mainly attributable to the longer time required for changing prescribing behavior, especially in the primary care setting where the majority of diabetes treatment takes place.

The chart above highlights the revenue performance of Trulicity in the US and international markets. The graph also shows the growth trends for Trulicity’s total prescriptions in the US compared with the overall market.

Trulicity growth trends

In 1Q18, Trulicity reported $678.3 million in revenues for YoY growth of ~82.0%. This drug reported Eli Lilly’s second-highest level of earnings. Its growth is supported by strong demand owing to favorable access and established real-world efficacy.

In April 2005, Eli Lilly and Amylin Pharmaceuticals received FDA approval for its GLP-1 receptor agonist, Byetta, as an adjunctive therapy for Type 2 diabetes patients. In November 2009, the drug was also approved as a monotherapy in Type 2 diabetes indications. Currently, Byetta belongs in AstraZeneca’s (AZN) drug portfolio.

In January 2010, Novo Nordisk (NVO) secured FDA approval for its GLP-1 receptor agonist, Victoza, in the Type 2 diabetes indications.

In September 2014, Trulicity (dulaglutide) was approved by the FDA as a once-weekly subcutaneous injection for controlling glycemic values in Type 2 diabetes patients. In December 2017, Novo Nordisk (NVO) secured FDA approval for its once-weekly GLP-1 receptor agonist, Ozempic.

The addition of new drugs plays a pivotal role in the increasing adoption of the GLP-1 class of drugs. With rising market opportunities, Eli Lilly is confident of witnessing 20.0%–30.0% YoY revenue growth for its market-leading GLP-1 therapy, Trulicity, going forward.

In the next article, we’ll discuss ongoing research programs for Trulicity and growth prospects for Jardiance.