Monster Beverage’s Valuation: Impact of 1Q17 Results

On May 5, 2017, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings multiple) of 31.1x, up 3.7% in reaction to its 1Q17 results.

Nov. 20 2020, Updated 11:27 a.m. ET

Impact of 1Q17 results

On May 5, 2017, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings multiple) of 31.1x, up 3.7% in reaction to its 1Q17 results.

As we discussed earlier in this series, Monster Beverage was in line with the analysts’ earnings estimates, but it missed sales estimates in 1Q17.

Peer comparison

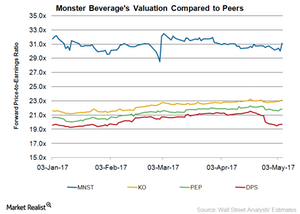

Monster Beverage continues to trade at a higher valuation multiple than its nonalcoholic beverage peers The Coca-Cola Company (KO), PepsiCo (PEP), and Dr Pepper Snapple (DPS). On May 5, Coca-Cola, PepsiCo, and Dr Pepper Snapple were trading at 12-month forward PEs of 23.1x, 21.8x, and 19.7x, respectively.

Monster Beverage was also trading at a higher valuation multiple than the S&P 500 Index’s 18.7x and the S&P 500 Consumer Staples Index’s 21.2x.

Forward PE varies among companies based on many factors, including growth expectations and risk-return profiles.

Analysts’ expectations

Analysts expect Monster Beverage’s sales to rise 11.2% to $3.4 billion in 2017. Analysts expect the company’s adjusted EPS (earnings per share) to rise 14.6% to $1.49 in 2017. Monster Beverage’s strong brand portfolio is enjoying continued demand in domestic and international markets.

However, health-conscious consumers are choosing better beverage options such as ready-to-drink tea and bottled water. This shift is impacting the volumes of soda beverages and energy drinks. In general, energy drinks are performing better than conventional carbonated soft drinks.

Monster Beverage’s strategic deal with Coca-Cola is expected to strengthen its international position. The company is planning to launch new products in several markets. For instance, at the end of April, the company launched a new Lewis Hamilton signature Monster Energy drink in Great Britain. The drink will be launched in 24 European markets in 2Q17 and in South Africa in July 2017. Monster Beverage is also planning to relaunch its products in India this year.

On Monster’s 1Q17 conference call, its chair and CEO, Rodney Sacks, mentioned that the company would be introducing a line extension of its Mutant brand called White Lightning—a zero sugar offering—to limited customers. The company launched Mutant, a super soda, in limited convenience stores in certain US markets in September 2016. The company also plans to launch Hydro, a noncarbonated lightly sweetened energy drink, to the general retail trade by the end of May.

For more updates, visit our Nonalcoholic Beverages page.