What’s JPMorgan Chase’s Valuation?

JPMorgan Chase (JPM) stock has generated a return of 21.0% in the last six months and 31.3% over the past year.

March 26 2018, Updated 7:33 a.m. ET

Relative performance

JPMorgan Chase (JPM) stock has generated a return of 21.0% in the last six months and 31.3% over the past year. The bank continues to receive a premium on core banking expansion, investment banking fees, and asset management growth. Trading activity continues to be weak due to debt offerings. However, in 1Q18, volatility is expected to increase on rate hike expectations, trade wars, and valuations.

In 4Q17, JPM managed a 10% return on book equity and 12% on capital employed, lower by 1% sequentially. Credit offtake and trading activity will be major drivers for the bank in 2018.

Amid higher interest rates and lower taxes, banks (XLF) could find it difficult to increase credit offtake at a faster pace in the US. Thus, global exposure and emerging market presence could help US banks to expand their lending book as well as improve their non-interest earnings.

Premium valuations

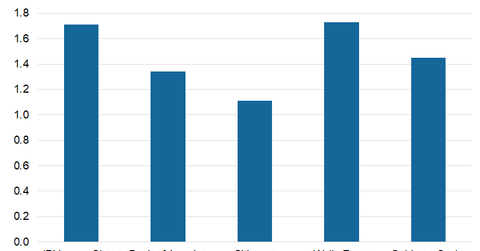

JPMorgan Chase is trading at a premium valuation of 1.71x in March 2018 compared to the industry average of 1.50x. The bank commands a premium mainly due to a strong brand, diversified earnings, and strong risk management policies, and its leadership position in core and investment banking.

Overall, the banking industry is seeing some revaluations owing to interest rate hikes and improvements in the macroeconomic scenario. JPMorgan’s competitors are trading at the following price-to-book multiples:

Trading activity, credit offtake, and trade wars are going to be a major determinant of how banks expand their lending and other activities in 2018. On the valuations front, the upside seems limited. However, the scope of earnings expansion is higher in 1H18.