How We Could Avoid Yield Curve Inversion

Could yield curve inversion be avoided? St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. Previously, we looked at the causes of yield curve inversion. In this part, we’ll review Bullard’s suggestions to avoid yield curve inversion. Bullard said that yield curve inversion could be avoided […]

Dec. 12 2017, Updated 7:31 a.m. ET

Could yield curve inversion be avoided?

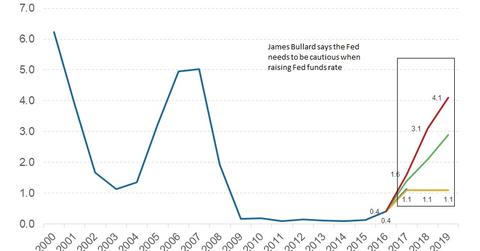

St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. Previously, we looked at the causes of yield curve inversion. In this part, we’ll review Bullard’s suggestions to avoid yield curve inversion. Bullard said that yield curve inversion could be avoided if long-term nominal interest (TLT) rates increase with policy rates, or inflation (TIP) expectations increase.

Policymakers should be cautious

In his presentation, Bullard said that the simplest way for US policymakers to avoid near-term yield curve inversion is to remain cautious when raising interest rates (AGG). He said that the St. Louis Fed’s policy rate recommendations are flat over the forecast period, meaning that no interest rate hikes should be announced unless the economy improves as expected. This argument makes sense, as the current market conditions reflect the sentiment that the Fed may be acting before seeing economic progress and inflation (VTIP) increases.

Other strategies to avoid yield curve inversion

Bullard listed other strategies to avoid yield curve inversion, including longer-term real interest rate increases and elevated investor expectations for higher inflation (TIPZ). However, he added that neither of these scenarios seems possible at this point. He concluded by saying that only the Federal Open Market Committee has the ability to stop yield curve inversion and avoid US recession.