Short Interest in Enterprise Products and Magellan Rose Recently

The short interest as a percentage of float in Enterprise Products Partners’ (EPD) stock is 1.8%—higher than the 1.7% in mid-August.

Aug. 31 2017, Updated 9:06 a.m. ET

Short interest in EPD

The short interest as a percentage of float in Enterprise Products Partners’ (EPD) stock is 1.8%—higher than the 1.7% in mid-August. According to data released on August 24, 2017, the total number of Enterprise Products Partners shares shorted was ~26.6 million on August 15—8% higher than the ~24.6 million shorted shares on July 31. The current short interest in EPD is on the higher side compared to an average of ~1.1% over the past five years.

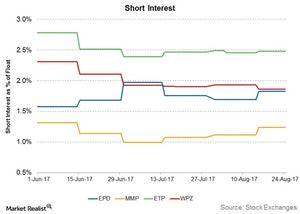

The above graph compares the short interest in EPD, Magellan Midstream Partners (MMP), Energy Transfer Partners (ETP), and Williams Partners (WPZ) since the start of 2017.

Short interest in MMP

The short interest as a percentage of float in Magellan Midstream Partners stock is 1.2%—higher than the 1.1% in mid-August. The current short interest in Magellan Midstream Partners is, however, on the lower side compared to an average of ~1.3% over the past five years.

The total number of Magellan Midstream Partners shares shorted was ~2.8 million on August 15—11% higher than the ~2.5 million shorted shares on July 31.

Short interest in ETP

The short interest as a percentage of float in Energy Transfer Partners stock is 2.5%—marginally higher compared to mid-August. The total number of Energy Transfer Partners shares shorted was ~25.5 million on August 15—0.8% higher than the ~25.3 million shorted shares on July 31. The current short interest in Energy Transfer Partners is on the higher side compared to an average of ~2.2% over the past five years.

Short interest in WPZ

The short interest as a percentage of float in Williams Partners stock is 1.9%—lower compared to mid-August. The current short interest in Williams Partners is also on the lower side compared to an average of ~2.3% over the past five years. The total number of Williams Partners shares shorted was ~4.9 million on August 15—3.6% lower than the ~5.0 million shorted shares on July 31.