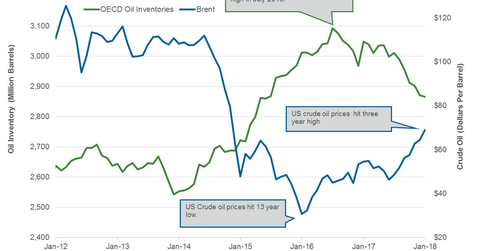

OECD’s Crude Oil Inventories Are near June 2015 Low

According to the EIA, OECD’s crude oil inventories declined 0.2% to 2,865 MMbbls in January 2018—compared to the previous month.

Sept. 15 2019, Updated 9:02 p.m. ET

OECD’s crude oil inventories

According to the EIA, OECD’s (Organisation for Economic Cooperation and Development) crude oil inventories declined 0.2% to 2,865 MMbbls (million barrels) in January 2018—compared to the previous month. Crude oil inventories are near the lowest level since June 2015.

OECD’s crude oil inventories declined by 183.4 MMbbls or 6% between January 2017 and January 2018 due to ongoing production cuts and strong oil demand. Brent and the US crude oil prices rose ~25% and 21% during the same period.

The United States Brent Oil ETF (BNO) and the United States Oil ETF (USO) track Brent and US crude oil futures, respectively. BNO and USO rose ~24% and 15%, respectively, between January 2017 and January 2018.

OECD’s crude oil inventories peaked

OECD’s oil inventories hit 3,093 MMbbls in July 2016—the highest level ever. Brent crude oil prices averaged ~$45 per barrel in July 2016. OECD’s oil inventories have declined 7.4% since July 2016. Brent crude oil prices have increased ~53% from July 2016 to January 2018. Inventories and oil prices are inversely related. The United States Brent Oil ETF (BNO) rose ~37% during this period.

Impact

OECD’s oil inventories averaged 2,968 MMbbls in 2016 and 2,870 MMbbls in 2017. The EIA estimates that OECD’s oil inventories could average 2,915 MMbbls in 2018 and 2,986 MMbbls in 2019. The rise in OECD crude oil inventories is bearish for oil prices. The rise in US crude oil production and non-OPEC production in 2018 could lead to the rise in OECD crude oil inventories.

Production cuts, unplanned supply outages, and strong demand could draw down global crude oil inventories in 2018, which is bullish for oil prices.

Next, we’ll discuss some crude oil price forecasts.