Key Highlights from Cliffs Natural Resources’ 2Q17 Results

Cliffs Natural Resources (CLF) achieved revenues of $569 million for 2Q17, an increase of 15% year-over-year (or YoY).

July 31 2017, Updated 7:41 a.m. ET

Revenue summary

Cliffs Natural Resources (CLF) achieved revenues of $569 million for 2Q17, an increase of 15% year-over-year (or YoY). These revenues were also 17% higher than the analyst consensus estimate of $486 million. The top-line beat came mainly on the back of higher volumes in the United States Iron Ore (or USIO) division (SPY)(SPX).

Cliffs Natural Resources’ US peers (SLX) U.S. Steel Corp (X) and ArcelorMittal (MT) shipped higher steel volumes in 2Q17 sequentially while AK Steel’s (AKS) shipments fell. Part of the fall in AKS’s shipments was expected, as it’s deliberately stepping away from the commodity-grade steel market to focus on value-added products.

EBITDA rose YoY

Cliffs Natural Resources’ EBITDA (earnings before interest, tax, depreciation, and amortization) reached $137 million in 2Q17—impressive growth of 35% YoY. The company’s strong performance was mainly due to higher realized prices in the US iron ore (or USIO) division. The EBITDA for USIO was $162 million for 2Q17—the company’s best quarterly performance since 2014. The EBITDA from its Asia-Pacific iron ore (or APIO) unit was just $3 million tons, mainly due to lower realized prices and lower shipments.

Net earnings

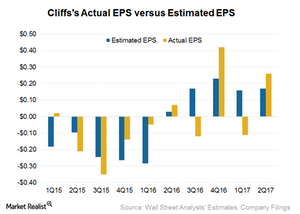

Cliffs Natural Resources (CLF) reported a net income of $77 million in 2Q17, versus $30 million in 2Q16.

Cliffs downgraded its net income guidance from $380 million to ~$310 million for 2017. It also reduced its EBITDA guidance to $650 million from $700 million. This new guidance is based on the assumption that iron ore and steel prices will still average their year-to-date averages for the rest of the year.

In the next part of this series, we’ll take a look at the how the volumes in the US segment progressed during the quarter.