Overview of Boston Scientific, a Leading Medical Device Company

Starting in 2011, Boston Scientific (BSX) has undertaken cost-cutting programs and reorganization efforts to turn the company’s battered financials around. In 2014, BSX started registering positive growth and profitability.

May 13 2016, Published 2:00 a.m. ET

A brief overview of Boston Scientific

Headquartered in Marlborough, Massachusetts, Boston Scientific (BSX) is one of the leading medical device companies in the US. The company focuses on the development of less-invasive technologies for the treatment of various medical conditions.

These treatment areas include:

- electrophysiology

- endoscopy

- interventional cardiology

- neuromodulation

- peripheral interventions

- rhythm management

- neurology and pelvic health

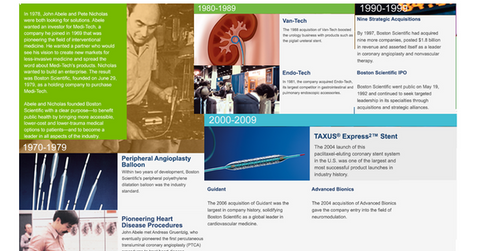

The illustration below lists the company’s key milestones through 2010.

The Fortune 500 company operates in more than 100 countries, employs more than 24,000 people, and manufactures around 13,000 diverse products.

Boston Scientific is a leader in the coronary stents market. Among its leading products include Taxus, a drug-eluting stent; the Watchman-Left Atrial Appendage Closure Device, which was designed to reduce stroke risk; and Emblem, a minimally invasive implantable cardioverter-defibrillator (or ICD).

Boston Scientific’s history

Boston Scientific (BSX) was founded in 1979 by John Abele and Peter Nicholas as a holding company for Medi-Tech. Medi-Tech was formed by John Abele in 1969 to market an innovative product, the steerable catheter, for use in minimally invasive surgeries. Gall bladder surgery was the first application of the steerable catheter. The company expanded over the years into other areas, including cardiovascular, respiratory, urological, and gastrointestinal applications.

In 1979, Boston Scientific reported revenues of $2 million and grew to $16 million by 1983. In the wake of growing capital needs, Abbott Laboratories purchased a 20% stake in the company. By 1991, the company’s sales reached $230 million. In 1992, Boston Scientific went public with its IPO, raising around $400 million in capital. Abbott Laboratories sold back its shares to Boston Scientific.

Acquisitions, challenges, and competition

In 1994, Boston Scientific (BSX) began a four-year strategic acquisition program that led to a large number of acquisitions. These acquisitions broadened the company’s geographical reach and product portfolio with entry into new markets and niche product areas. Boston Scientific’s market capitalization increased from $1.5 billion at the end of the year 1994 to $8.5 billion at the end of 1995.

During the late 1990s, Boston Scientific witnessed some disruptions in sales and a product recall, which led the company to undertake restructuring initiatives that included a change in management. Litigation and several recalls delayed a number of product launches by the company.

This led its major competitors, including Medtronic (MDT) and Guidant Corporation, to gain an edge, which impacted Boston Scientific’s sales and its market sentiments. That led to a drastic fall in its share price—Boston Scientific’s stock price fell by ~57% from mid-1999 to February 2000.

In March 2004, Boston Scientific launched the Taxus stent in the United States. Johnson & Johnson (JNJ) launched the Cypher medicated stent in 2003 and had the first mover’s advantage in the drug-coated stent market. However, Taxus delivered better results. Consequently, Boston Scientific soon captured ~70% of the drug-coated stent market share.

On April 21, 2006, Boston Scientific acquired one of its major competitors, Guidant, for $27.2 billion. The large size of the acquisition impacted the company’s bottom line in the following years. The company also suffered due to a number of recalls and litigations, including the controversial lawsuit regarding the sales of Guidant’s faulty defibrillators. Other legal challenges included several patent fights, as well as lawsuits filed by the patients who suffered injuries related to transvaginal mesh complications.

Starting in 2011, Boston Scientific has undertaken cost-cutting programs and reorganization efforts to turn the company’s battered financials around. In 2014, Boston Scientific started registering positive growth and profitability, and it has witnessed stable valuations.

Boston Scientific’s major competitors

Some of Boston Scientific’s major competitors in the United States include Medtronic, Johnson & Johnson, and Abbott Laboratories (ABT). Investors can invest in the Health Care Select Sector SPDR ETF (XLV), which holds ~1.1% of its total holdings in BSX.

In the next article, we’ll take a look at Boston Scientific’s business model.