Why Activision Blizzard’s Revenues Are Expected to Rise in Fiscal 2018

Analysts expect Activision Blizzard’s (ATVI) revenues to rise 10.8% YoY (year-over-year) to $1.33 billion in 1Q18.

March 14 2018, Updated 3:10 p.m. ET

Revenues expected to grow ~5% in 2018

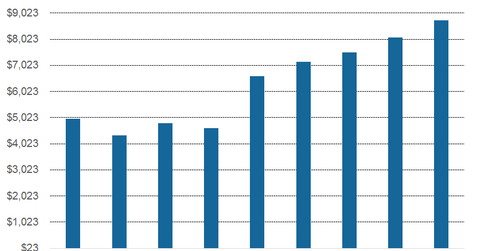

Analysts expect Activision Blizzard’s (ATVI) revenues to rise 10.8% YoY (year-over-year) to $1.33 billion in 1Q18. They also expect its revenues to rise 5.3% YoY to $1.49 billion in 2Q18 and 5.1% YoY to $7.52 billion in 2018. For fiscal 2019, revenues are expected to rise ~7.5% to $8.1 billion, and in fiscal 2020, they’re expected to rise ~8% to $8.75 billion in 2020.

ATVI’s revenues rose 42% YoY to $6.6 billion in 2016 and 8.5% YoY to $7.15 billion in 2017, driven by its diversified portfolio of games and an increase in digital revenues. Its EBITDA (earnings before interest, tax depreciation, and amortization) rose from $1.55 billion in 2015 to $2.45 billion in 2016 and $2.52 billion in 2017. This figure is expected to be $2.83 billion in 2018, $3.25 billion in 2019, and $3.54 billion in 2020.

Revenues for peer gaming companies Electronic Arts (EA), Take-Two Interactive (TTWO), Netease (NTES), and Zynga (ZNGA) are estimated to rise 4.4%, 6.6%, 29%, and 7.3%, respectively, over the next fiscal year.

Profit margins

ATVI’s operating margin was just over 31% in 2013. The company’s operating margin expanded to 35.4% in 2016, and the firm reported operating margin of 33.5% last year. Analysts expect an operating margin of 34.9% in 2018 with a net margin of 19.4%. Profit margins are estimated to rise in fiscal 2018 and 2019 as well.

Its non-GAAP (generally accepted accounting principles) EPS (earnings per share) are expected to rise 13% to $0.35 in 1Q18, 11.6% to $0.48 in 2Q18, 15% to $2.6 in fiscal 2018, and 14.5% to $3.00 in fiscal 2019.