What Are Analysts Saying about Marathon Oil?

Recommendations Currently, 30 analysts cover Marathon Oil (MRO). They’ve given six “strong buy,” six “buy,” 17 “hold,” and one “sell” recommendation on the stock. There were no “strong sell” recommendations. Target price Analysts’ median target price for MRO is $20, which is ~25% higher than the closing price of $16.05 on February 9, 2017. The mean […]

Feb. 13 2017, Updated 10:36 a.m. ET

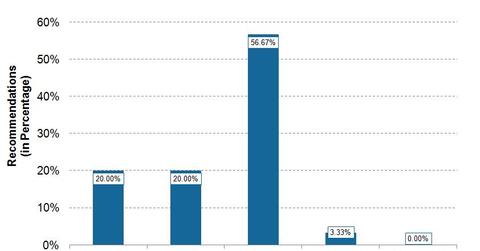

Recommendations

Currently, 30 analysts cover Marathon Oil (MRO). They’ve given six “strong buy,” six “buy,” 17 “hold,” and one “sell” recommendation on the stock. There were no “strong sell” recommendations.

Target price

Analysts’ median target price for MRO is $20, which is ~25% higher than the closing price of $16.05 on February 9, 2017. The mean target price for MRO is $20.38, which is higher than the median target price.

Changes in the last three months

In the last three months, analysts’ “strong buy” recommendations for MRO have risen from four to six. “Buy,” “hold,” “sell,” and “strong sell” ratings have remained unchanged.

In the last three months, Marathon Oil’s median and mean target prices have risen. During this time, MRO’s median target price has risen from $18 to $20, whereas its mean target price has risen from $18.15 to $20.38.