Sanofi’s Revenue Growth in 2Q17

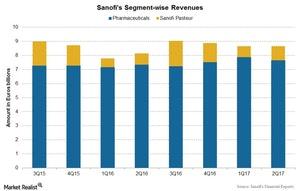

Sanofi’s revenue in 2Q17 At constant exchange rates, Sanofi (SNY) reported revenue growth of ~5.5% between 2Q16 and 2Q17, with revenue rising to 8.7 billion euros from 8.1 billion euros. Structure of the group The above chart shows Sanofi’s segment-wise revenue over the last few quarters. In 2016, Sanofi reorganized itself into five business units: Sanofi […]

Aug. 17 2017, Updated 7:37 a.m. ET

Sanofi’s revenue in 2Q17

At constant exchange rates, Sanofi (SNY) reported revenue growth of ~5.5% between 2Q16 and 2Q17, with revenue rising to 8.7 billion euros from 8.1 billion euros.

Structure of the group

The above chart shows Sanofi’s segment-wise revenue over the last few quarters. In 2016, Sanofi reorganized itself into five business units:

- Sanofi Genzyme, which represents the specialty care business, including oncology and rare disease drugs

- General Medicines and Emerging Markets

- Diabetes and Cardiovascular

- Consumer Healthcare

- Sanofi Pasteur, which represents the human vaccine business

The company also announced two changes in the group’s business structure on January 1, 2017:

- Sanofi exchanged its animal health business, Merial, with Boehringer Ingelheim’s consumer healthcare business

- Sanofi terminated its European vaccine joint venture with Merck and Co. (MRK), Sanofi Pasteur MSD

At constant exchange rates, the company reported 0.6% revenue growth in 2Q17.

Segment-wise performance 2Q17

Sanofi’s business is reported in two segments:

- the Pharmaceuticals segment, which comprises Sanofi Genzyme, Diabetes and Cardiovascular, General Medicines and Emerging Markets, and Consumer Healthcare

- the Human Vaccines segment, which includes Sanofi Pasteur

The Pharmaceuticals segment’s revenue rose by 4.1% to 7.7 billion euros in 2Q17, compared with 7.4 billion euros in 2Q16. Sanofi Pasteur’s revenue rose by 27.5% to 1.0 billion euros in 2Q17, compared with 797 million euros in 2Q16.

To divest company-specific risks, investors could consider the VanEck Vectors Pharmaceutical ETF (PPH) which has a 5.2% exposure to Sanofi. PPH also has a 5.6% exposure to Novo Nordisk (NVO), a 5.1% exposure to Merck and Co. (MRK), and a 4.9% exposure to Eli Lilly and Company (LLY).