EOG Resources: Post-Earnings Wall Street Ratings

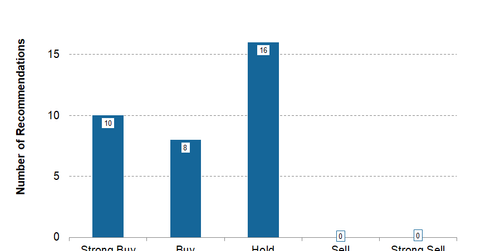

As of March 1, 2018, a total of 34 analysts have made recommendations on EOG Resources (EOG) stock, according to Reuters.

March 6 2018, Updated 10:31 a.m. ET

Analysts’ recommendations for EOG Resources

As of March 1, 2018, a total of 34 analysts have made recommendations on EOG Resources (EOG) stock, according to Reuters.

Of these, ~29% of analysts have “strong buy” recommendations on the stock, and ~24% have “buy” recommendations on the stock. The remaining ~47% of analysts have “hold” recommendations on EOG. There are no “sell” or “strong sell” recommendations on the stock.

EOG’s median target price

The median target price on EOG Resources stock is $123.00, which is ~22% higher than its March 1, 2018, closing price of $101.18. In the last three months, EOG Resources stock’s median target price has risen from $110.00 to $123.00.