How Vale Could Benefit from a Move to Quality in Iron Ore

Vale has changed its product portfolio and quality in iron ore according to market demand. In 2017, it’s more focused on selling high-quality ore.

Dec. 11 2017, Updated 12:25 p.m. ET

Quality premium to boost earnings?

Vale’s (VALE) ferrous division accounted for ~87.6% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) in 3Q17, compared with ~82% in 2Q17.

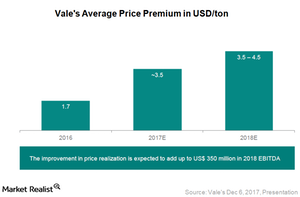

Vale has changed its product portfolio and quality in iron ore according to market demand. In 2017, it’s more focused on selling high-quality ore since China’s fight against pollution has led to a huge variance between high-grade and low-grade material. Vale plans to lower the amount of ore sold from its southern mines, which is lower quality ore, to 8% in 2018 from 22% in 2016. Iron ore with a content of 62% and above is trading at a premium to the sub-62% ore, and the differential is expected to expand due to the ongoing shift toward lower polluting sources of ore. Currently, China is paying almost five times more premium than it was paying two years ago. Vale expects its average premium to be $3.50–$4.50 per ton in 2018 and $3.50 per ton in 2017 compared to $1.70 per ton in 2016. That’s expected to add up to $350 million in EBITDA for Vale in 2018.

Iron ore operational yield

Vale is also focusing more on dry processing. While the company is currently dry processing 40% of its ore, in 2020, it plans to dry process 70%. The process could be very cost-effective. Vale also put out a slide showing how, because of an increasing share of dry processing and strip ratio optimization, its operational yield is becoming higher than its peers. In 2014, Vale had only 4% higher operational yield. Now, the gap is increasing and is expected to be 10% in 2017 and 17% in 2018. That implies that its peers could be going more for wet processing, which could ultimately negatively impact costs.

Iron ore costs

Vale expects unit costs to fall across the board as new mines ramp up. Its own costs are expected to fall significantly with the continued ramp-up of its S11D project. As production volumes from S11D increase from 22 million tons in 2017 to 90 million tons in 2020, the unit C1 cash costs are expected to fall to $7.70 per ton from $14.50 per ton currently. That would make Vale the lowest cash cost producer among the major iron ore miners. Its peer (PICK) Rio Tinto (RIO) had a unit cost of $13.80 per ton for its Pilbara operations in the first half of 2017. BHP’s (BHP) unit cost for fiscal 2017 (ended June 2017) was $14.60 per ton. Cleveland-Cliffs (CLF), which has different drivers than its seaborne peers, also reduced its production costs in the United States.