Reading the Recent Gold-Silver Spread

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

Jan. 5 2018, Updated 9:03 a.m. ET

Gold and silver spread

When analyzing the movement of the precious metals, it’s instructive for us to analyze the comparative performance of the metals. Gold is commonly known as the big brother of precious metals because its price direction often causes the other metals to follow.

Below, we’ll look at the spread reading of silver, platinum, and palladium, taking gold as our base.

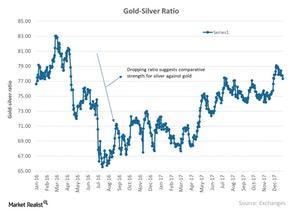

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

Silver hit a three-week high price of $16.6 on Tuesday, December 26, while gold was trading at $1,287 an ounce. Funds that closely track the rise and fall in gold and silver include the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR). These two funds have seen YTD (year-to-date) rises of 11.6% and 4.4%, respectively.

Technical analysis

As of December 27, the gold-silver spread was 77.2. This level indicates that it takes almost 77 ounces of silver to buy a single ounce of gold. The RSI (relative strength index) level of the gold-silver spread is at 30. Such a low level indicates the possibility of a revival in the spread.

As you can see in the graph above, the ratio has been steadily rising, which indicates that more ounces of silver are required to buy a single ounce of gold. Similarly, any fall in the ratio indicates strength for silver.

Mining stocks that are also considerably impacted by the interplay between gold and silver and the overall mining industry include Pan American Silver (PAAS), Coeur Mining (CDE), Royal Gold (RGLD), and Newmont Mining (NEM).

In the next part, we’ll continue this discussion by looking at the gold-palladium spread.