These Developments Impacted Abbott Laboratories the Most in Fiscal 2017

Abbott Laboratories posted a strong earnings results on January 24, surpassing Wall Street estimates and posting earnings at the high end of its guidance.

Sept. 14 2019, Updated 6:44 a.m. ET

ABT’s eventful year

Abbott Laboratories (ABT) posted a strong earnings results on January 24, 2018, surpassing Wall Street estimates and posting earnings at the higher end of its guidance. ABT stock registered a rise of more than 4% that day.

Abbott Laboratories had an eventful year in 2017, with a number of key strategic acquisitions, divestitures, and product launches. These developments had a significant impact on the company’s performance in fiscal 2017. Below, we’ll discuss some of these key developments and their impact on ABT’s business.

St. Jude acquisition

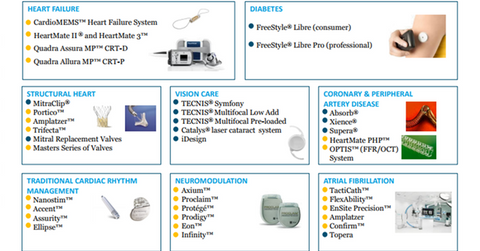

Abbott Laboratories completed the acquisition of St. Jude Medical in January 2017. This has positioned Abbott as one of the leading medical device players, especially in an estimated $30 billion cardiovascular market.

With the St. Jude acquisition, Abbott has also entered the neuromodulation market space, competing with the likes of Medtronic (MDT), Nevro (NVRO), and Boston Scientific (BSX).

The Alere acquisition

Abbott Laboratories has expanded and strengthened its market position in the diagnostics space with its acquisition of Alere. The deal was completed in October 2017 after the two companies resolved a series of litigations among them, which started when the deal was announced in February 2016.

However, the company expects to register significant synergies going forward, as the acquisition expands Abbott’s presence in rapid diagnostics market. (For details, check out “Understanding Abbott’s Alere Acquisition: What We Can Expect.“)

The sale of Abbott’s medical optics business

Abbott Laboratories completed the sale of its medical optics business to Johnson & Johnson (JNJ) in February 2017. The company divested this profitable business unit in order to focus on its core businesses and establish a strategically aligned business. For its rationale at the time of the deal announcement, check out “The Rationale behind Johnson & Johnson’s Acquisition of Abbott Medical Optics.”

Any such event could also impact the stock price movement of the S&P 500 ETF (SPY), which has ~0.46% of its total portfolio holdings in ABT stock.