Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]

Dec. 20 2016, Updated 7:37 a.m. ET

Mining stocks and gold

Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling.

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC). These companies have risen significantly year-to-date (or YTD). Mining companies often amplify the returns of precious metals. However, the past few weeks have been choppy for these mining companies.

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals. However, the demand for these mining companies seems to be in danger due to the recent fall in precious metal prices.

Correlation trends

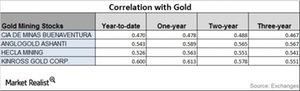

As you can see in the above table, Kinross is the most correlated with gold on a YTD basis among the four stocks under review. Buenaventura is the least correlated with gold, mainly due to its YTD losses.

Kinross and Hecla have seen their correlations with gold rise. Kinross’s correlation rose from a ~0.55 three-year correlation to a ~0.61 one-year correlation. A correlation of ~0.61 suggests that about 61% of the time, Kinross has moved in the same direction as gold. Usually, a fall in gold leads to a fall in the prices of mining stocks, while a rise in gold leads to increases in mining share prices.

The relationship between gold, Buenaventura, and AngloGold hasn’t been stable, with correlations rising and falling. Leveraged mining funds such as the Direxion Daily Gold Miners Index Bull 3X Shares ETF (NUGT) and the ProShares Ultra Silver ETF (AGQ) have fallen due to the decline in precious metals.