Inside Novartis’s Segment-Wise Performance in 1Q17

Novartis is largely exposed to currency risk, as ~50% of its total revenues are reported from international markets.

June 1 2017, Updated 9:09 a.m. ET

Novartis’s revenues

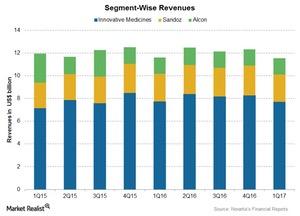

Novartis (NVS) reported 2% operational growth to $11.54 billion in its 1Q17 revenues. Due to the -3% impact of foreign exchange, NVS’s revenues fell 1% in 1Q17.

Notably, Novartis is largely exposed to currency risk, as ~50% of its total revenues are reported from international markets and ~50% of its total revenues are reported from US markets.

1Q17 revenues

Novartis’s reported revenues of ~$11.5 billion in 1Q17, which represents a 1% YoY (year-over-year) decline. This included 2% operational growth, which was more than offset by the -3% impact of foreign exchange.

Novartis’s Innovative Medicines segment reported 2% operational growth, while its eye care business, Alcon, reported 1% operational growth. The generics business, Sandoz, also reported 1% operational growth in 1Q17.

Innovative Medicines

NVS’s Innovative Medicines segment includes two business units: pharmaceuticals and oncology. The segment’s revenues fell to $7.69 billion in 1Q17, as compared to $7.7 billion in 1Q16, as its operational growth of 2% was offset by the negative impact of foreign exchange.

Sandoz

Sandoz is NVS’s generic pharmaceuticals business. Its revenues fell to $2.43 billion in 1Q17, as compared to $2.45 billion in 1Q16, with its operational growth of ~1% being offset by the negative impact of foreign exchange.

Alcon

Alcon is NVS’s eye care business. Its revenues fell to $1.42 billion in 1Q17, as compared to $1.43 billion in 1Q16, and its operational growth of 1% was offset by the negative impact of foreign exchange.

To divest risk, investors can consider ETFs like the PowerShares International Dividend Achievers’ ETF (PID), which has 1.5% of its total portfolio in Novartis. PID also has 1.9% of its total portfolio in Novo Nordisk (NVO), 1.9% in Sanofi (SNY), and 1.5% in Teva Pharmaceuticals (TEVA).