How JNJ’s Pulmonary Hypertension Portfolio Performed in 3Q17

In 3Q17, in the US and outside the US (international markets), JNJ’s pulmonary hypertension portfolio generated revenues of $357 million and $283 million, respectively.

Dec. 29 2017, Updated 10:30 a.m. ET

Pulmonary hypertension revenue trends

Johnson & Johnson’s (JNJ) pulmonary hypertension portfolio earned revenues of $670 million in 3Q17. In 3Q17, in the US and outside the US (international markets), JNJ’s pulmonary hypertension portfolio generated revenues of $357 million and $283 million, respectively. JNJ’s pulmonary hypertension portfolio reported year-to-date September 2017 revenues of $761 million. In June 2017, Johnson & Johnson acquired Actelion at a price of around $30 billion in cash. In June 2017, Actelion became a part of Johnson & Johnson’s subsidiary Janssen Pharmaceuticals.

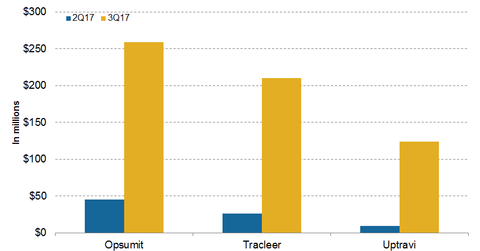

Opsumit revenue trends

In 3Q17, Johnson and Johnson’s (JNJ) Opsumit generated revenues of $670 million compared to $91 million in 2Q17. In 3Q17, in the US and international markets, Opsumit reported revenues of $150 million and $109 million, respectively. Opsumit reported YTD September 2017 revenues of $304 million.

Tracleer revenue trends

In 3Q17, Tracleer generated revenues of $210 million compared to $26 million in 2Q17. In 3Q17, in the US and international markets, Tracleer generated revenues of $83 million and $127 million, respectively. Tracleer reported YTD September 2017 revenues of $236 million.

Uptravi revenue trends

In 3Q17, Uptravi generated revenues of $124 million compared to $9 million in 2Q17. In 3Q17, in the US and international markets, Uptravi generated revenues of $113 million and $11 million, respectively. Uptravi reported YTD September 2017 revenues of $133 million.

Opsumit (macitentan), Tracleer (bosentan), and Uptravi (selexipag) are used to treat individuals with pulmonary arterial hypertension (or PAH) (WHO group 1). In the PAH drugs market, Johnson & Johnson’s drugs compete with Bayer’s (BAYZF) Adempas, United Therapeutics’ (UTHR) Remodulin, and Gilead Sciences’ (GILD) Letairis. In 3Q17, Remodulin and Letairis generated revenues of $187 million and $213 million, respectively. The revenue growth of Johnson & Johnson’s PAH portfolio could boost the First Trust Nasdaq Pharmaceuticals ETF (FTXH). Johnson & Johnson makes up about ~7.9% of FTXH’s total portfolio holdings.