Williams Partners’ Distribution Growth Plans

Williams Partners (WPZ) expects its 2017 distributable cash flow to lie between $2.6 and $2.8 billion. At the midpoint, this range represents a ~9.0% YoY (year-over-year) decline.

Jan. 22 2018, Updated 9:03 a.m. ET

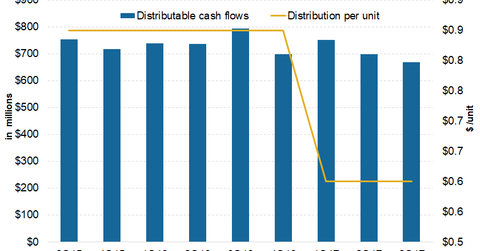

Williams Partners’ distributable cash flow growth

Williams Partners (WPZ) expects its 2017 distributable cash flow to lie between $2.6 and $2.8 billion. At the midpoint, this range represents a ~9.0% YoY[1. year-over-year] decline. The expected fall in the partnership’s distributable cash flows is mainly due to an EBITDA[2. Earnings before interest, tax, depreciation, and amortization] decline resulting from contract restructurings and asset sales. The partnership expects to maintain a distribution coverage of 1.17x by the end of this year.

Williams Partners’ distribution guidance

Williams Partners announced a flat distribution of $0.6 per unit for the third quarter of 2017, which represented a 29% YoY decline compared to 3Q16. Williams Partner announced a 29% distribution cut, effective 1Q17, as part of the financial repositioning plan. Previously, the partnership kept its distribution flat at $0.85 per unit for eight quarters. WPZ is targeting an annual distribution growth of 5%–7% over the next several years. Wall Street analysts’ expectations are in line with the partnership’s distribution guidance. They expect a distribution CAGR (compound annual growth rate) of 6.6% in 2018–2020, which is significantly higher than the industry median of 1.6%.

Williams Partners’ distribution yield

Based on the third-quarter distribution, the partnership is trading at an attractive distribution yield of 5.6%—higher than the dividend yield of the S&P 500 ETF (SPY) at 1.8%. However, it’s lower than the Alerain MLP ETF’s (AMLP) 7.5%. WPZ’s lower yield compared to AMLP might reflect the partnership’s lower expected earnings volatility compared to most other AMLP constituents.

In the next part of this series, we’ll look into the partnership’s leverage position.