Why Oil Prices Could Lose Momentum

On January 25, 2018, US crude oil’s (USO) (USL) March 2018 futures fell 0.2% and settled at $65.51 per barrel.

Nov. 20 2020, Updated 4:35 p.m. ET

US crude oil

On January 25, 2018, US crude oil’s (USO) (USL) March 2018 futures fell 0.2% and settled at $65.51 per barrel. On January 24, 2018, US crude oil futures were at their three-year high.

Even though US crude oil inventories declined in the week ended January 19, 2018, the rise in gasoline inventories and US crude oil production hitting record levels could hinder oil’s upside. These factors could be behind the small decline in oil prices on January 25, 2018.

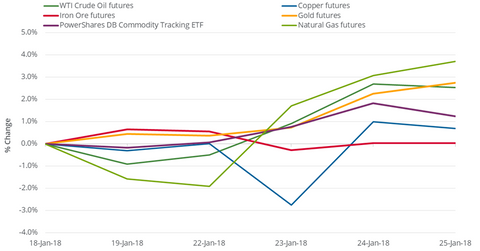

Between January 18 and January 25, 2018, US crude oil futures rose 2.5%. The S&P 500 Index (SPY) (SPX-INDEX) and the Dow Jones Industrial Average Index (DIA-INDEX) rose 1.5% and 1.4%, respectively, during this period. Part two of this series will focus on the impact of oil on these equity indexes.

Natural gas

On January 25, 2018, natural gas (UNG) (BOIL) March 2018 futures rose 0.6% and settled at $3.09 per MMBtu (million British thermal units). In the week ended January 19, 2018, the EIA (U.S. Energy Information Administration) reported a fall of 288 Bcf (billion cubic feet) in natural gas inventories, while the market had expected a fall of 270 Bcf. So, the inventory data supported natural gas prices in the last trading session. In the trailing week, natural gas futures rose 3.7%.