Alcoa’s 2017 Guidance: Everything You Need to Know

Alcoa (AA) expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017 compared to 13.2 million metric tons in fiscal 2016.

Feb. 8 2017, Updated 7:37 a.m. ET

Alcoa’s 2017 guidance

It’s important for investors in the metals and mining space (CENX) (RIO) to follow production and shipment data. Mining companies’ revenues are functions of commodity prices and shipments.

Miners (NHYDY) don’t have pricing power due to the commoditized nature of their businesses. So, changes in shipments tend to determine how one company’s revenue changes compared to the others. We can also gain crucial insight into the market’s supply-demand balance by looking at major producers’ production figures. In this article, we’ll look at Alcoa’s 2017 shipment guidance.

Bauxite sales expected to increase

Alcoa (AA) (ARNC) expects to ship between 47.5 million–48.5 million bone dry metric tons (or Mbdmt) of bauxite in fiscal 2017 compared to 45.0 Mbdmt in fiscal 2016. Bauxite could be a key growth driver for Alcoa after the split. Until now, most of the bauxite that Alcoa had mined was consumed in its captive alumina operations.

In fiscal 2015, Alcoa generated revenues of only $71 million from third-party bauxite sales. However, it has been aggressively pursuing bauxite sales over the last few quarters. It signed contracts valued at ~$600 million for 2016 and 2017.

Alumina and aluminum

Alcoa (AA) expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017 compared to 13.2 million metric tons in fiscal 2016. While Alcoa expects to produce more bauxite and alumina this year, the company’s aluminum shipments are expected to be stagnant.

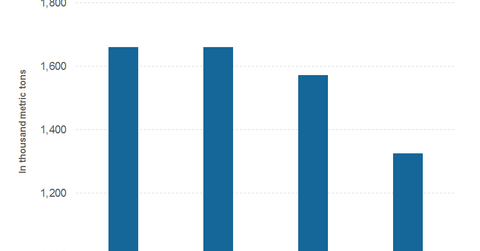

Alcoa expects to produce between 2.3 million–2.4 million metric tons of aluminum in 2017 compared to 2.42 million metric tons in 2016.

Meanwhile, Alcoa has been focusing on its bottom line rather than its top line. In the next article, we’ll look at Alcoa’s 2017 profitability guidance.