What’s Charles Schwab’s Valuation?

Charles Schwab (SCHW) has a price-to-earnings ratio of 20.80x on an NTM (next-12-month) basis.

Nov. 20 2020, Updated 4:29 p.m. ET

Higher valuations

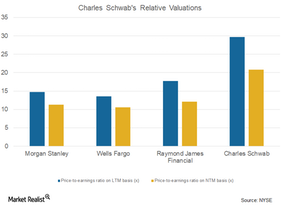

Charles Schwab (SCHW) has a price-to-earnings ratio of 20.80x on an NTM (next-12-month) basis, which implies a premium valuation, as the average for competitors is 11.30x. Morgan Stanley (MS), Wells Fargo (WFC), and Raymond James Financial (RJF) have price-to-earnings ratios of 11.26x, 10.55x, and 12.10x, respectively, on an NTM basis.

Charles Schwab has premium valuations primarily because of its strong 1Q18 results. The company exceeded analysts’ expectations on both earnings per share (or EPS) and revenues. Moreover, increased fluctuations in the equity markets in 1Q18 positively impacted Charles Schwab’s trading revenues.

Total client assets

Charles Schwab saw a decline in total client assets in March 2018 compared to February 2018, which might concern market participants. In 1Q18, the company’s net income amounted to $783 million compared to $564 million in 1Q17, implying a 39% increase.

Charles Schwab’s 1Q18 results were positively affected by favorable momentum in net interest revenues. The company’s futures trading capabilities consist of new features that could positively impact the company’s trading volumes.

On an LTM (last-12-month) basis, Charles Schwab’s price-to-earnings ratio stood at 29.71x, while peers (XLF) Morgan Stanley, Wells Fargo, and Raymond James Financial have ratios of 14.76x, 13.54x, and 17.72x, respectively.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look here!