What Factors Are Driving the Euro Higher?

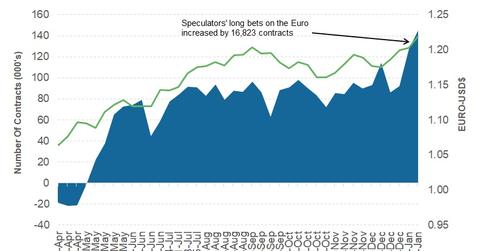

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week.

Jan. 16 2018, Updated 4:00 p.m. ET

Euro registers a three-year peak

The euro–dollar (FXE) exchange rate scaled a three-year high to close the week ended January 12 at 1.2187, appreciating by ~1.3% against the US dollar (UUP). The key reason behind the surge in the European currency was the unexpectedly hawkish tone of the European Central Bank’s (or ECB) meeting minutes.

The minutes of the December ECB meeting revealed that the central bank is comfortable with the current economic performance and could consider tightening its monetary policy in the months ahead. This announcement drove the euro above the 1.21 mark against the US dollar.

Although European equity markets (VGK) remained upbeat, the German DAX (DAX) witnessed a minor drop of 0.53% for the week ended January 12. The Euro Stoxx (FEZ) and France’s CAC appreciated by 0.14% and 0.85%, respectively.

Euro speculators increase bullish bets

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week. The total net speculative bullish positions on the euro (EUFX) increased from 127,868 contracts in the previous week to 144,691 contracts on January 9.

Speculators increasing their bullish positions at multiyear highs can be considered a sign of confidence of further gains in the European currency.

Outlook for the euro

Continued positive momentum, aided by a weak US dollar and strong European economic performance, could drive the European currency to a higher valuation against the US dollar this week. On the economic data front, final inflation data is expected to improve and add to the positive factors driving the euro higher.

In the next part of this series, we’ll discuss why the British pound surged to an 18-month high in the previous week.