What Do Wall Street Analysts Think of Equity Residential?

Analysts gave EQR a mean price target of $69.08, implying a ~8.3% rise from its current level of $63.77.

Jan. 10 2018, Updated 9:02 a.m. ET

Analyst ratings

Equity Residential’s (EQR) performance expectations in 2018 are apparent in its analyst ratings. Analysts gave EQR a mean price target of $69.08, implying a ~8.3% rise from its current level of $63.77. It has a market capitalization of about $23.4 billion.

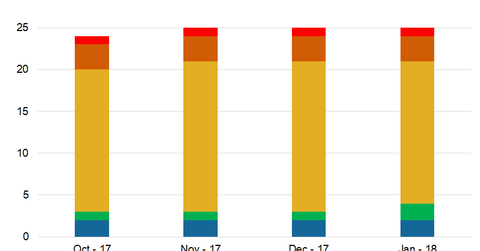

As of January 2018, four of 25 analysts covering the stock gave it “buy” or “strong buy” ratings. The remaining 17 analysts gave it a “hold” rating, while three analysts gave it an “underperform” rating, and one analyst gave it a “sell” rating. Compared to December 2017, Equity Residential’s “strong buy” and “buy” ratings came up from three to four.

Equity Residential’s peer ratings

Among Equity Residential’s major peers, AvalonBay Communities (AVB) got “buy” or “strong buy” ratings from 13 of 25 analysts and “hold” ratings from 11 analysts. The target price for AVB is $200.68. Nine of 22 analysts gave Camden Property (CPT) “buy” or “strong buy” ratings, and 11 analysts gave it a “hold” rating. The target price for CPT is $96.90.

Eight of 26 analysts gave Essex Property (ESS) “buy” or “strong buy” ratings, and sixteen analysts gave it a “hold” rating. One analyst gave it a “hold” and “sell” rating. The target price for ESS is $267.13.

Investors looking for exposure to residential real estate can invest in REIT ETFs. Equity Residential makes up 7.3% of the iShares Residential Real Estate ETF (REZ).