Camden Property Trust

Latest Camden Property Trust News and Updates

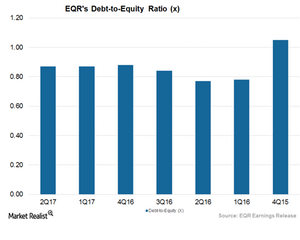

How Equity Residential Improved Its Balance Sheet in 2Q17

During 2Q17, Equity Residential (EQR) reported higher-than-expected top-line and bottom-line results backed by robust rent growth and occupancy levels.

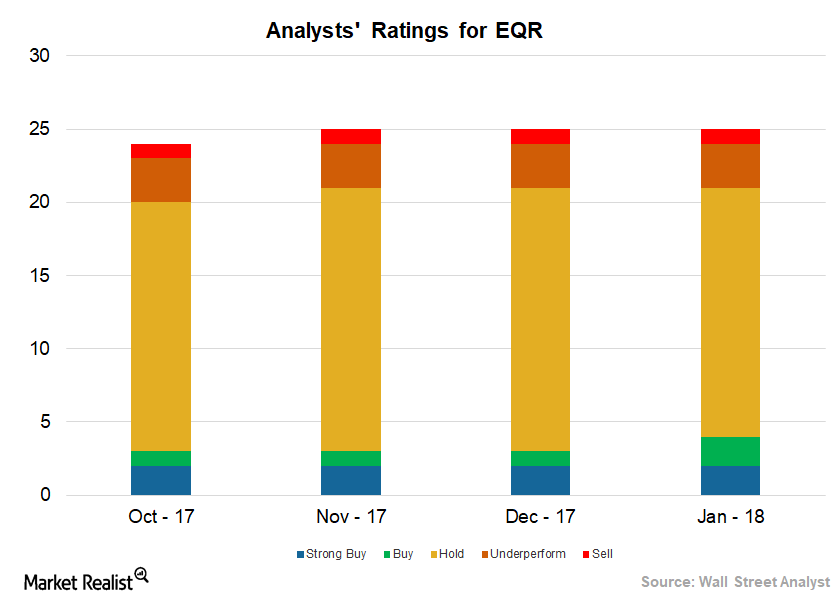

What Do Wall Street Analysts Think of Equity Residential?

Analysts gave EQR a mean price target of $69.08, implying a ~8.3% rise from its current level of $63.77.

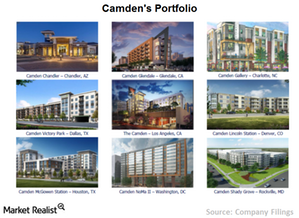

Camden Property Trust: Its History and Its Business

Camden Property Trust (CPT) is the fifth largest apartment REIT in the United States. At the end of fiscal 2014, it had 181 multifamily properties comprised of 63,163 apartment homes.

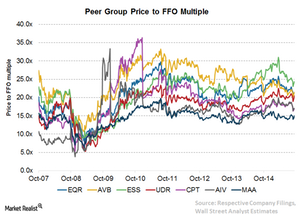

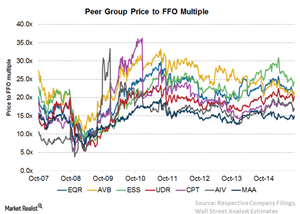

Why Essex Property Trust Trades at a High Price-to-FFO Multiple

A close look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it’s in line with its historical valuation.

Analyzing Equity Residential’s Higher Price-to-FFO Multiple

The most common way to calculate the relative value of a REIT like Equity Residential (EQR) is the price-to-FFO (funds from operations) multiple.

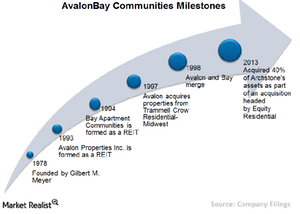

Investing in AvalonBay Communities: A Must-Know Company Overview

AvalonBay Communities is a REIT focused on developing, redeveloping, acquiring, and managing high-quality apartment communities in high barrier-to-entry US markets.

Investing in Equity Residential: A Company Overview

Equity Residential was formed as a REIT. It became a publicly traded company in 1993. It’s part of the S&P 500 Index. It employs about 3,500 people.