General Mills Announces Restructuring Plans

General Mills fell by 1.1% to close at $71.22 per share in the third week of July. Its weekly, monthly, and YTD price movements were -1.1%, 8.0%, and 26.2%.

July 25 2016, Published 1:21 p.m. ET

Price movement

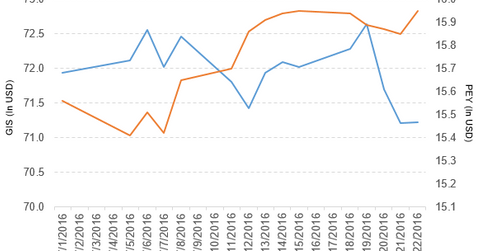

General Mills (GIS) fell by 1.1% to close at $71.22 per share during the third week of July 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were -1.1%, 8.0%, and 26.2%, respectively, as of July 22. GIS is trading 1.2% above its 20-day moving average, 7.3% above its 50-day moving average, and 18.9% above its 200-day moving average.

Related ETF and peers

The PowerShares High-Yield Equity Dividend Achievers Portfolio ETF (PEY) invests 1.6% of its holdings in General Mills. The ETF aims to track a yield-weighted index of US companies that have increased their annual dividend for at least ten consecutive years. The YTD price movement of PEY was 22.0% on July 22.

The market caps of General Mills’ competitors are as follows:

Latest news on General Mills

In fiscal 1Q17, General Mills has planned to restructure its product line in its international segments with the elimination of excess capacity in Marlia, Brazil, in Sao Bernardo do Campo, Brazil, and in Nanjing, China. This action will affect ~420 positions in Brazil and ~440 positions in Greater China operations. The company expects ~$42 million in charges related to the layoffs, which includes ~$8 million in employee severance and $33 million in impairment charges to write down assets to its net realizable value.

The company has also planned to eliminate excess soup capacity in its US Retail supply chain. This action will affect ~370 positions. It expects ~$18 million in severance expenses related to layoffs and ~$34 million in additional expenses in fiscal 2017, primarily in fixed asset write-offs.

General Mills has entered into an agreement to sell its plant in Martel, OH. This agreement will affect ~180 positions and is expected to close in fiscal 2017. It expects a loss of ~$11 million from the sale of this plant during the quarter in which the transaction closes.

General Mills’ performance in fiscal 4Q16 and fiscal 2016

General Mills reported fiscal 4Q16 net sales of $3.9 billion, a fall of 9.3% from its net sales of $4.3 billion in fiscal 4Q15. Sales from the US Retail, International, and Convenience Stores and Foodservice segments fell by 12.2%, 1.5%, and 7.8%, respectively, between fiscal 4Q15 and 4Q16. In fiscal 4Q16, its net income and EPS (earnings per share) rose to $379.6 million and $0.62, respectively, as compared to $186.8 million and $0.30 in fiscal 4Q15.

Fiscal 2016 results

In fiscal 2016, GIS reported net sales of $16.6 billion, a fall of 5.7% YoY (year-over-year). It reported a gain on divestitures of $148.2 million in fiscal 2016. YoY, the company’s gross profit margin and operating profit rose by 4.5% and 30.3%, respectively, in fiscal 2016.

In fiscal 2016, its net income and EPS rose to $1.7 billion and $2.77, respectively, as compared to $1.2 billion and $1.97 in fiscal 2015. In fiscal 2016, GIS’s cash and cash equivalents rose by 128.5%, and its inventories fell by 8.3%. In fiscal 2016, its current ratio and debt-to-equity ratio rose to 0.79x and 2.93x, respectively, as compared with 0.75x and 2.90x in fiscal 2015.

Projections

The company has made the following projections for fiscal 2017:

- organic net sales growth between 0% and -2%

- total segment operating profit growth in the range of 6%–8% on a constant-currency basis

- adjusted operating profit margin growth of ~1.5%

- adjusted EPS growth in the range of 6%–8% on a constant-currency basis

The company has made the following projections for fiscal 2018:

- modest organic net sales growth

- adjusted EPS growth in the low double digits on a constant-currency basis

In the next part of this series, we’ll discuss Campbell Soup.