Are Supply Concerns Pushing Oil Higher?

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high.

Nov. 20 2020, Updated 11:35 a.m. ET

US crude oil

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high. US crude oil inventory and production data supported oil prices after the data were released on January 10, 2018.

The ongoing economic crisis in Venezuela could decrease the nation’s oil output. On January 5, 2018, Reuters reported that the OPEC (Organization of the Petroleum Exporting Countries) compliance rate for December 2017 could rise because of the fall in Venezuela’s oil output. The current diplomatic tussle between the United States and Iran over the nuclear deal could further increase oil’s supply concerns.

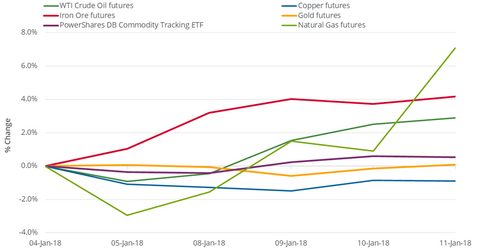

Between January 4 and January 11, 2018, US crude oil futures gained 2.9%. The S&P 500 Index (SPY) (SPX-INDEX) and the Dow Jones Industrial Average Index (DIA-INDEX) rose 1.6% and 2%, respectively, over that period. In the next part, we’ll analyze oil’s contribution to the gains of these equity indexes.

Natural gas

On January 11, 2018, natural gas (UNG) (BOIL) February 2018 futures rose 6.1% and settled at $3.08 per MMBtu (million British thermal units). The EIA (U.S. Energy Information Administration) reported a record fall of 359 Bcf (billion cubic feet) in natural gas inventories for the week ended January 5, 2018. In the week ended December 29, 2017, natural gas inventories were 5.8% below their five-year average. But the fall pushed natural gas inventories further to 6.3 percentage points below the five-year average, a bullish sign for natural gas prices. The spike in natural gas prices on January 11, 2018, pushed its trailing week gains to 7.1%.