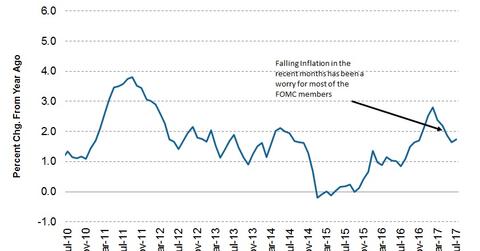

Why Inflation Remains a Huge Concern for FOMC Members

Members of the FOMC (Federal Open Market Committee) attributed the recent slowdown in inflation growth to idiosyncratic factors.

Aug. 18 2017, Updated 4:36 p.m. ET

Members attributed inflation to idiosyncratic factors

Members of the FOMC (Federal Open Market Committee) attributed the recent slowdown in inflation (TIP) growth to idiosyncratic factors. They also pointed out that monthly inflation (VTIP) readings might have been depressed by the effects of seasonality in the measure of inflation (SCHP), especially in PCE (personal consumption expenditures). A decline in inflation growth has been cited as the main reason that many analysts have forecast a slower pace of rate hikes. Fed members have also been worried about slower inflation growth and believe that continued lower inflation levels should limit the current monetary tightening measures.

Reasons for coexistence of low inflation and low unemployment

In their July meeting, FOMC members also discussed the reasons for the coexistence of low inflation (TDTT) and low unemployment. They cited lower responsiveness of prices to resource pressures, which means that despite a reduction in supply, prices have not been rising. The members said that the natural rate of unemployment has shifted lower from historical levels. The Fed considers 4.5% as a natural level of unemployment, and this level might have to be lowered in the future.

Other labor market indicators could provide a better explanation for low inflation

FOMC members argued that other market indicators such as wage growth, the pricing power of global developments, and changes in business models influenced by technological advances should be considered when forecasting inflation. Despite the recent slowdown, most members indicated that they expect inflation to pick up over the next two years and reach the 2.0% target level. Overall, lower levels of inflation will keep the Fed from increasing interest rates too quickly, thus putting further downward pressure on bond (BND) yields and help the prices of bonds surge higher.

In the next part of this series, we’ll look at FOMC members’ views on US unemployment.