European Markets Are Mixed in the Morning Session on January 26

At 4:25 AM EST on January 26, the DAX Index was trading at 13,306.50—a gain of 0.06%. The iShares MSCI Germany (EWG) fell 0.7% on January 25.

Jan. 26 2018, Published 9:36 a.m. ET

United Kingdom

After losing strength last week and breaking a six-week gaining streak, the United Kingdom’s FTSE 100 Index started this week on a weaker note. After a brief rebound on Tuesday amid the end of the US government shutdown, the FTSE 100 Index resumed its decline. On Friday, the FTSE 100 Index opened the day higher and traded with strength above the opening prices in the morning session.

Market sentiment

The market sentiment is mixed this week amid optimism about corporate earnings and the lower risk appetite. On Thursday, the FTSE 100 Index fell amid strength in the sterling. Strength in the US and Asian markets caused European markets to start Friday on a stronger note. The market is supported by the top performer of the day—National Grid Group, which rose following an upgrade from Goldman Sachs.

According to the Office for National Statistics, the United Kingdom’s GDP in 4Q17 surged to 0.5%, which is higher than the market forecast of 0.4%. The market is looking forward to Bank of England Governor Carney’s speech at 9:00 AM EST today.

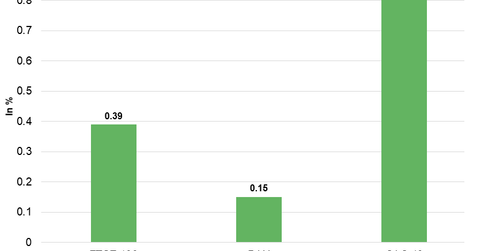

At 4:20 AM EST today, the FTSE 100 Index was trading at 7,643.00—a gain of 0.36%. The iShares MSCI United Kingdom (EWU) fell 0.66% on January 25.

Germany

After regaining strength last week and closing at ten-week high price levels, Germany’s DAX 30 Index started this week on a stronger note but lost strength as the week progressed. Despite the release of stronger-than-expected economic data and corporate earnings, the DAX 30 Index lost strength on Thursday amid a rise in the euro. The DAX 30 Index is stable in the morning session on Friday and trading above opening prices.

At 4:25 AM EST on January 26, the DAX Index was trading at 13,306.50—a gain of 0.06%. The iShares MSCI Germany (EWG) fell 0.7% on January 25.

France

After consolidating in a range for two weeks, France’s CAC 40 Index started this week on a stronger note but reversed the direction mid-week amid the dented sentiment. Strength in the euro is weighing on the CAC 40 Index. On Friday, the CAC 40 Index opened the day higher and traded with strength in the morning session. On the economic data front, according to INSEE, the France Business Survey recorded 113 in January—higher than the expectation of 112.

At 4:30 AM EST on January 26, the CAC 40 Index was trading at 5,528.50—a gain of 0.86%. The iShares MSCI France (EWQ) fell 0.12% on January 25.

Next, we’ll discuss how US Treasury yields and the US dollar performed in the early hours on January 26.