European Markets Were Stronger Early on January 23

At 5:05 AM EST on January 23, the DAX Index was trading at 13,574.50—a rise of 0.82%. The iShares MSCI Germany (EWG) rose 0.62% on January 22.

Jan. 23 2018, Published 11:33 a.m. ET

United Kingdom

After pulling back last week, the United Kingdom’s FTSE 100 Index started this week on a weaker note. However, the FTSE 100 Index regained strength on Tuesday and opened the day higher. In the morning session, the FTSE 100 Index is trading with strength above opening prices.

Market sentiment

The market pulled back last week amid increased caution in the market and profit-booking. The market sentiment improved at the beginning of this week due to the expectation of upbeat corporate earnings releases. However, the risk appetite declined on Monday and weighed on the market amid the US government shutdown. The risk appetite in European markets improved on Tuesday when the US government shutdown ended. On the economic data front, according to the Office for National Statistics, the United Kingdom’s public sector net borrowing in December declined to 0.98 billion pounds from 6.65 billion pounds in November.

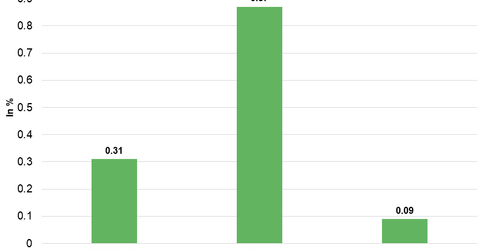

At 5:00 AM EST today, the FTSE 100 Index was trading at 7,739.50—a gain of 0.31%. The iShares MSCI United Kingdom (EWU) rose 0.86% on January 22.

Germany

After regaining strength last week and surging to ten-week high price levels, the DAX Index started this week on a stronger note. On Tuesday, the DAX Index opened the day higher and traded at fresh record high price levels. There was improved hope for political stability amid votes for coalition talks. On the economic data front, according to ZEW, the Germany ZEW Economic Sentiment surged to 20.4 in January, which is higher than the forecasted reading of 17.8.

At 5:05 AM EST on January 23, the DAX Index was trading at 13,574.50—a rise of 0.82%. The iShares MSCI Germany (EWG) rose 0.62% on January 22.

France

After consolidating in a range for two weeks, France’s CAC 40 Index started this week on a stronger note. On Tuesday, the CAC 40 Index opened the day higher at decade-high price levels and traded with strength at elevated levels in the morning session. Increased expectations on upcoming corporate releases and the improved global growth outlook are supporting the CAC 40 Index.

At 5:15 AM EST today, the CAC 40 Index was trading at 5,547.00—a gain of 0.1%. The iShares MSCI France (EWQ) rose 0.6% on January 22.

In the next part, we’ll discuss how US Treasury yields and the US dollar performed in the early hours on Tuesday.