Analyst Ratings and Recommendations for Novartis

As of April 21, 2017, there are five analysts tracking Novartis. Of those, two have recommended a “strong buy,” and one has recommended a “buy.”

April 24 2017, Updated 10:37 a.m. ET

Wall Street analysts’ estimates

In 4Q16, Novartis (NVS) met Wall Street analysts’ estimates for EPS (earnings per share) at $1.12. However, the company missed analysts’ estimates for revenues in 4Q16 and reported revenues of ~$12.3 billion against estimated revenues of ~$12.4 billion.

For 1Q17, analysts estimate EPS of $1.12 with revenues of ~$11.7 billion compared to $11.6 billion in 1Q16.

Analysts’ ratings

Novartis stock has fallen nearly 3.9% over the last 12 months and has risen ~1.1% in 2017 year-to-date. The stock has a potential to rise ~15.8% over the next 12 months. Analyst recommendations show a 12-month target price of $85.25 per share compared to $73.62 on April 20, 2017.

Analyst recommendations

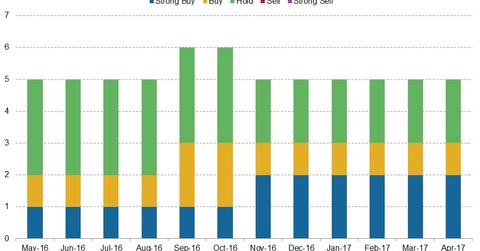

As of April 21, 2017, there are five analysts tracking Novartis. Of those, two have recommended a “strong buy,” and one has recommended a “buy.” Two analysts have recommended a “hold.” Changes in analysts’ estimates and recommendations are based on the changing trends in a stock price and the performance of a company. The consensus rating for Novartis stands at 2.0, which represents a moderate “buy” for long-term growth investors.

To divest the risk, you can consider ETFs such as the PowerShares International Dividend Achievers ETF (PID), which holds 1.1% of its total assets in Novartis (NVS), 1.1% in Teva Pharmaceutical (TEVA), 2.4% in GlaxoSmithKline (GSK), and 1.5% in Sanofi (SNY).