How Microsoft Contributed to the S&P 500’s High in 2017

On January 16, 2018, MSFT stock rose 1.3% to an all-time intraday high of $90.79, which made the company’s market cap briefly cross the $700 billion mark.

Jan. 24 2018, Updated 10:30 a.m. ET

Microsoft: The third company in the S&P 500 to cross the $700 billion threshold

In the previous part of this series, we looked at the stellar performance of Microsoft (MSFT) stock, which surged 38% in 2017. On January 16, 2018, MSFT stock rose 1.3% to an all-time intraday high of $90.79, which made the company’s market cap briefly cross the $700 billion mark. Microsoft thus became the third company after Apple (AAPL) and Google (GOOG) to have a market cap greater than $700 billion and the third stock in the S&P 500 (VOO) index to cross the $700 billion threshold.

In terms of market cap, Microsoft is ahead of Amazon (AMZN), which has a market cap of $625 billion. Although Microsoft lags behind Amazon in the overall cloud space, when it comes to market cap, Microsoft is ahead of Amazon.

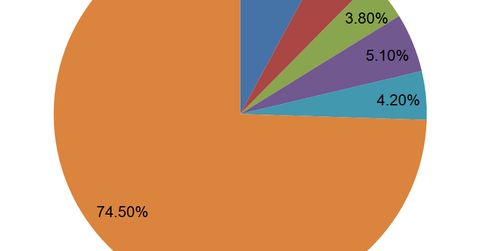

Five technology players accounted for a fourth of S&P’s gain in 2017

As the above presentation by Bloomberg shows, Facebook (FB), Apple, Amazon, Microsoft, and Alphabet/Google are the technology stocks that accounted for a fourth of the S&P 500’s rally last year.

These five players accounted for 5.2% of the S&P’s total gain of 23.7% in 2017. In general, the technology sector, which grew 34% in 2017, contributed the most to the S&P 500’s momentum in 2017.

In 2017, the Dow Jones Industrial Average and the Nasdaq Composite rose 25% and 28%, respectively.