Inside Edwards Lifesciences’ THV Product Pipeline and Future Growth Estimates

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product.

Dec. 16 2016, Updated 9:06 a.m. ET

Product pipeline

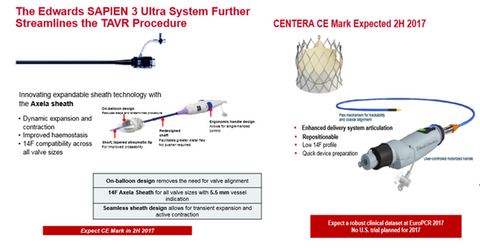

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product. The product is currently being used for the treatment of high-risk and intermediate-risk patients. The company has also started the study for the use of products in low-risk patients, which make up ~50% of the AS (aortic stenosis) patient population.

EW’s Centera valve is a self-expandable repositionable enhanced delivery system. It’s expected to have better procedural outcomes, with higher efficiency and shortened procedure time. Its FIH (first-in-human) experience, notably, showed promising results and is under clinical study in Europe. It’s expected to receive its CE Mark in 2H17.

Global sales growth outlook

Edwards Lifesciences has witnessed strong growth in its TAVR sales over the years. Sales in 2Q16, however, took a hit due to the reduced shipments to France, following the French government’s policy of limiting minimally invasive procedures.

But EW has reported the issue as resolved, with no impact in subsequent quarters. The company expects to generate THV therapy sales growth of 15%–20% for 2016. Growth is expected to be driven by excellent product outcomes, improving TAVR market dynamics, and increased demand. But the increasing competition and pricing pressures in the healthcare industry might impact EW’s growth in this segment.

Competition and ETFs

Medtronic’s (MDT) Corevalve is a direct competitor with EW’s Sapien valve for the treatment of patients with high risk. St. Jude Medical (STJ) and Boston Scientific (BSX) are also undergoing trials for their TAVR products and present a potential competition. Notably, the iShares Core S&P 500 ETF (IVV) has ~0.10% of its total holdings in EW.

In the next part, we’ll discuss EW’s structural heart initiatives.