A Look at Miners’ Correlation Trends

AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation.

Jan. 11 2018, Updated 9:10 a.m. ET

Correlation to gold

Gold is the most prominent among the precious metals, and the other three tend to take a directional move from gold. In this part of the series, we’ll look at the correlation movement of miners AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO).

Mining funds also have a close-knit relationship with the price changes in gold and other precious metals. The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the iShares MSCI Global Gold Miners (RING) have fallen 5.3% and 2.8%, respectively, in the last five trading days. Gold has also reported losses during that period.

Reading the trends

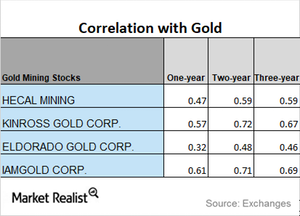

Among the four miners that we’re discussing, AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation. The correlation of miners to gold over the past year has been moderately lower than previous years.

All these four miners have two-year correlations with gold that are higher than their one-year and three-year correlations. Kinross Gold’s three-correlation is 0.67, its two-year correlation is 0.73, and its one-year correlation is 0.56. A correlation of 0.56 indicates that during the past year, Kinross Gold has moved in the same direction as gold about 56% of the time.

The movement of mining shares to gold is crucial. In the next part, we’ll get some insight into miners’ future price directions.