Is Bitcoin a Bubble?

The price of bitcoin (SOXL) (SOXX) has risen 69,278.6% over the last five years. On the other hand, in the last seven days, it has plummeted 27% to $12,466.

Jan. 23 2018, Updated 6:00 p.m. ET

VanEck

Is bitcoin a bubble that can go to zero?

No doubt that bitcoin is in a speculative updraft that will end one day. But the huge percentage price increases themselves prove nothing — remember the initial price of Alibaba, Amazon, or Google stock? These companies were started in garages. Apple stock was probably valued at $0.01 per share when it started and rose thousands of percent before its IPO.

Interestingly, if bitcoin were to go to zero, we believe it is unlikely to create systemic financial risk. This is due to the fact that we believe bitcoin exposure of financial institutions is limited to market-making and trading firms. There is greater system risk in the European debt markets, where junk bonds have lower interest rates than U.S. government debt despite debt levels being very high. A disruption in those markets would directly affect the financial system and stock and bond markets.

Market Realist

Sharp rise in the price of bitcoin raises concerns

The price of bitcoin (SOXL) (SOXX) has risen 69,278.6% over the last five years. On the other hand, in the last seven days, it has plummeted 27% to $12,466, or about 41% below its all-time high of $17,549.67 recorded in December 2017. A sharp rise and fall in the price of bitcoin can stoke fear of a bubble in the market.

Entry of institutions

Despite warnings from many prominent investors against bitcoin, institutions and traders are increasingly bracing themselves to explore growing public interest in the digital currency (ARKW). The CBOE (Chicago Board Options Exchange) and the CME (Chicago Mercantile Exchange) started listing bitcoin futures in December 2017. The entry of CBOE and CME into bitcoin futures provides confidence to users about the availability of the genuine market.

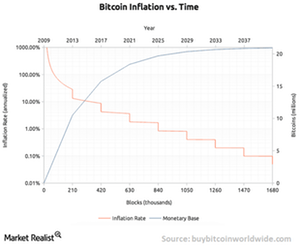

Although bitcoin has no asset-backed value, it is a scarce resource. The scarcity and acceptability by the wider user community create a demand for the digital currency. As long as demand is there, bitcoin could survive. These are still early days for the digital currency. The prices may need to settle down at some level in order for it to be accepted as an alternative currency (UUP) (FXE).