How Investors Can Access the Marijuana Industry

Investors interested in accessing the marijuana industry have several options.

Jan. 15 2018, Updated 9:04 a.m. ET

Accessing the marijuana Industry in the US

Investors interested in accessing the marijuana industry have several options. In the US, Scotts Miracle-Gro (SMG) has invested in companies that are positioned to serve the cannabis market.

SMG primarily provides lawn and garden products such as fertilizers (MOO), seeds, and crop protection products. To learn more about the company, check out Market Realist’s “Before Investing in Scotts Miracle-Gro, Read This.”

AbbVie (ABBV) sells a marijuana-based drug that has been approved by the FDA (US Food and Drug Administration), and Insys Therapeutics (INSY) and Corbus Pharmaceuticals (CRPB) have marijuana-based drugs in their pipelines.

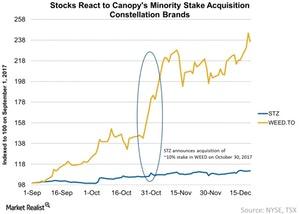

Constellation Brands (STZ) announced its acquisition of a 10% stake in Canopy Growth (WEED.TO) on October 30, 2017, which led to a rise in the stocks following the announcement.

In Canada

There are several companies active in the marijuana industry in Canada, including Aurora Cannabis (ACB.TO), Canopy Growth, and Aphria (APH.TO), and MedReleaf (LEAF.TO), but the expectation of the legalization of marijuana for recreational use may already be priced into these companies’ current stock prices.

ETFs

Investors in the US can also gain access to some of the above stocks through ETFs such as the ETFMG Alternative Harvest ETF (MJX), which seeks to invest in companies that are legally engaged in marijuana-based activities, including medical and non-medical uses around the world.

Similarly, there’s also the Horizons Marijuana Life Sciences Index ETF (HMLSF), which tracks the performance of the North American Medical Marijuana Index.