How USAC Deal Could Boost ETP’s Market Performance

Energy Transfer Partners (ETP) had a strong start to the year with a rise of ~6.5% in 2018 YTD (year-to-date).

Jan. 17 2018, Updated 9:03 a.m. ET

Market performance

Energy Transfer Partners (ETP) had a strong start to the year with a rise of ~6.5% in 2018 YTD (year-to-date). At the same time, the Alerian MLP ETF (AMLP), which consists of 25 energy MLPs, has risen ~8.3%. The deal with USA Compression Partners (USAC) is expected to further boost the partnership’s market performance driven by the strengthening of its balance sheet and reduced exposure to the Eagle Ford Basin. We’ll look into this in later articles.

Energy Transfer Partners’ moving averages

Energy Transfer Partners recently went above its long-term (200-day) moving average, which indicates a bullish sentiment in the stock. The partnership was trading 15.1% above its 50-day SMA (simple moving average) and 1.8% above its 200-day SMA as of January 16. At the same time, ETP peers Williams Partners (WPZ) and EnLink Midstream Partners (ENLK) were trading 9.8% and 5.8% above their 200-day moving average, respectively. The USAC deal, strong crude oil prices, an increase in drilling activity, and a positive earnings surprise could push Energy Transfer Partners further above its 200-day SMA.

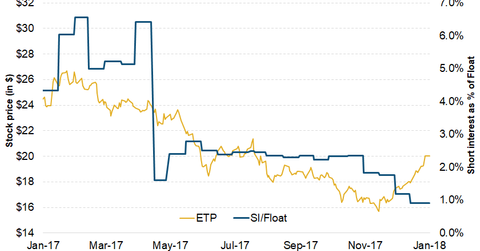

Short interest in Energy Transfer Partners

Short interest in Energy Transfer Partners was 9.9 million shares as of January 16, 2018. At the same time, short interest in ETP as a percentage of float ratio was 0.9%. The current short interest in ETP is lower than the 30-day average of 1.2%. Moreover, short interest in ETP is lower compared to the one-year and three-year average of 3.1% and 2.1%, respectively, which indicates a bullish sentiment in the stock.