What to Expect from Cleveland-Cliffs’ 4Q17 US Volumes

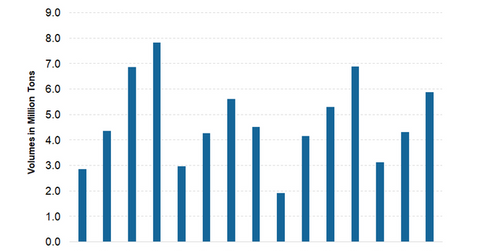

Cleveland-Cliffs (CLF) achieved US volumes of ~5.9 million tons in 3Q17, an increase of 11% year-over-year (or YoY).

Jan. 16 2018, Updated 5:10 p.m. ET

US volumes in 3Q17

Cleveland-Cliffs (CLF) achieved US volumes of ~5.9 million tons in 3Q17, an increase of 11% year-over-year (or YoY). The growth in the third quarter is attributable to higher customer demand and export sales. While the company achieved strong volume growth in 3Q17, its outlook for 4Q17 was weaker. It reduced the guidance for 2017 from 19.0 million tons to 18.5 million tons.

Expectations for 4Q17

The reduction in pellet nominations from one of its major customers led to this decline. This updated guidance from the company implies ~5.2 million tons of volumes in 4Q17, which would be a YoY decline of 24.0%. Usually, the fourth quarter is one of the best quarters in terms of volumes due to seasonality. The Great Lakes region freezes in the first quarter.

While the company has reduced its volume expectations for 4Q17, it doesn’t expect any residual impact in 2018 if the nominations return to normal levels. It’s guiding for volumes of 20 million tons for 2018. Investors should note that this includes volumes from its recently acquired Tilden mine.

Factors impacting volumes

The major reason for the downgrade in volumes for 4Q17 was increasing US steel imports. Cleveland-Cliffs’ CEO mentioned during its 3Q17 earnings call that he expects imports to fall in 2018. He stated that this trend could be supported by the Chinese government’s actions to restrict its steel output.

He also expects some relief from the pending decision on the Section 232 investigation into steel imports, which could be a positive catalyst for steel companies (SLX) such as AK Steel (AKS), U.S. Steel (X), Nucor (NUE), and ArcelorMittal (MT).