How Did Edwards Lifesciences’ Critical Care Segment Fare in 1Q16?

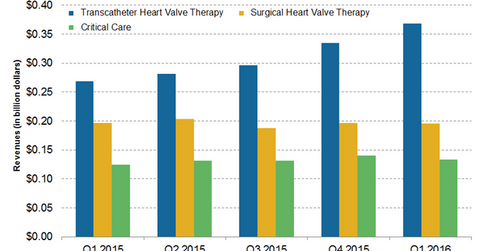

Edwards Lifesciences (EW) reported ~$697 million in total revenue in 1Q16. Of that, ~$134 million was contributed by the company’s Critical Care segment.

May 8 2016, Updated 7:06 a.m. ET

1Q16 performance

Edwards Lifesciences (EW) reported ~$697 million in total revenue in 1Q16. Of that, ~$134 million was contributed by the company’s Critical Care segment. The segment accounted for about 19% of Edwards Lifesciences’ total revenue. These sales figures represent a ~7% YoY (year-over-year) increase in 1Q16. The underlying sales growth was reported to be ~9% as compared to underlying sales growth of ~4% in the previous quarter.

Becton Dickinson (BDX), Medtronic (MDT), and Hospira, acquired by Pfizer (PFE) in 2015, are Edwards Lifesciences’ major competitors in the Critical Care segment. Investors can invest in the Vanguard Growth ETF (VUG) for diversified exposure to Edwards Lifesciences, which constitutes around 0.26% of VUG’s holdings.

Key growth drivers

The Critical Care products business is one of the core businesses of Edwards Lifesciences and is crucial for the company’s growth. The company is a leader in hemodynamic monitoring and offers products and solutions that provide economic and clinical benefits to its customers. The strong growth in the Critical Care products segment in 1Q16 was primarily driven by the wider adoption of Edwards Lifesciences’ market-leading critical care products in the United States, which was stimulated by recent investments in commercial initiatives.

Enhanced surgical recovery products also continue to generate demand and contribute to the segment’s growth. Moreover, the discontinuation of the company’s legacy monitors led to the increase in sales of replacement monitors, which contributed to the segment’s sales growth. The segment continued to generate double-digit underlying sales growth across most regions.

Edwards Lifesciences maintained its 2016 sales guidance for the Critical Care products segment at $510 million–$550 million, representing growth of 2%–4%.

In the next article in this series, we’ll look at Edwards Lifesciences’ updated guidance for 2016.