How Digital Assets Could Generate Income

Blockchain technology holds a lot of promise due to its many advantages such as transparency, faster transactions at lower costs, and a reliable system.

Jan. 23 2018, Updated 5:58 p.m. ET

VanEck

How do digital assets have value without cash flow?

Certainly there are investors who value assets based solely on current cash flow. However, assets exist (such as currencies) that are priced based on crowd-perceived value. Precious metals and modern art are obvious examples. Will a Monet, Basquiat or a Degas go to zero?

Bitcoin has attracted a widespread group of investors who, among other views, do not trust central governments. Other than acceptance by millions of investors globally, there is no reason why bitcoin is special.

There is potential that blockchains popularize and generate income streams. However, we are at a very early stage, similar to the early days of the Internet. One must have an aggressive growth risk tolerance to consider investing in early stage companies, much like an angel round or a series A.1

1A series A round is the name typically given to a company’s first significant round of venture capital financing; an angel round of funding is part of the seed round. Angel rounds usually refer to funding below $1 million, although they can somewhat more than that.

Market Realist

Possibility of generating income through digital assets

Currently, bitcoin (SOXX) is not considered a main asset class. It has no cash flow and no assurance of liquidity or security. It has not been widely accepted around the world. It is driven mainly by the scarcity that has been ensured by its founders.

Immense opportunities

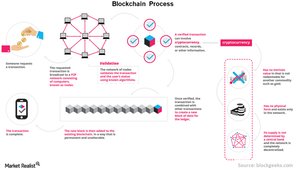

Blockchain, which powers bitcoin (ARKW), is the foundation of DLT (distributed ledger technology). Like the Internet (FDN), blockchain is also likely to witness gradual acceptance. We have seen in the past that technologies that are transformational in nature need to jump over many hurdles before they are widely accepted by the general public. Blockchain technology holds a lot of promise due to its many advantages such as transparency, faster transactions at lower costs, and a reliable system. Consequently, many financial institutions and exchanges are looking at applying this technology.

The ultimate scenario could be its wider use by central banks around the world, which could push digital currency (UUP) (FXE) to replace physical cash in the future. There is also a possibility that digital currency could gradually replace electronic payment systems that financial institutions use for their transactions.

The possible widespread use of blockchain technology could lower transaction costs and lessen the chances of fraud, thus ultimately generating income streams to users.