What’s Wells Fargo’s Valuation?

Wells Fargo (WFC) stock has risen 13.0% over the past six months and 10.1% over the past year.

Dec. 25 2017, Updated 7:30 a.m. ET

Stock performance

Wells Fargo (WFC) stock has risen 13.0% over the past six months and 10.1% over the past year. This rise has mainly been due to an expectation of improved operating performance in 4Q17 and 2018 on the back of interest rates, credit offtake, and some rebound in noninterest income.

Bankers (XLF) have faced slowing credit growth and lower trading activity offset by improvements in margins, investment banking, and the asset management business.

In 3Q17, Wells Fargo managed net income of $4.6 billion, lower than the $5.6 billion in the prior year, reflecting non-operating expenses’ impact on overall performance. The bank saw a 4% increase in net interest income and a 9% fall in non-interest income on lower mortgage services income.

Valuation premium stable

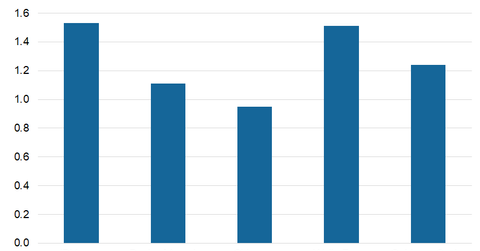

Wells Fargo is now trading at a PBV (price-to-book value) multiple of 1.65x compared to the industry average of 1.28x. The bank is trading at a premium to all major bankers including J.P. Morgan (JPM), Bank of America (BAC), and Citigroup (C) due to the expectation of some rebound in mortgages and related activities. Berkshire (BRK-B) has continued to hold on to its stake in the bank and is expecting a rebound in the short to medium term on the back of its strong franchise.

Wells Fargo’s book value per share rose to $36.96 in 3Q17 from $35.81 in the prior year. The bank garnered a return on equity (or RoE) of 9.1% in 3Q17 and a tier-one equity ratio of 11.8%, reflecting lower slippages and rising assets.

Originations, offtake, and mortgages will be key drivers for Wells Fargo’s performance in 4Q17 and 2018. Analysts are anticipating a recovery on those fronts in the upcoming quarters.