Wall Street Analysts’ Forecasts for National Oilwell Varco

On February 24, ~14% of the analysts tracking National Oilwell Varco rated it as a “buy,” ~74% rated it as a “hold,” and 12% rated it as a “sell.”

Nov. 20 2020, Updated 12:28 p.m. ET

Wall Street analysts’ forecasts for National Oilwell Varco

In this part, we’ll look at Wall Street analysts’ forecasts for National Oilwell Varco (NOV) stocks.

On February 24, 2017, ~14% of the analysts tracking National Oilwell Varco rated it as a “buy” or some equivalent. Approximately 74% rated the company as a “hold.” Only 12% of the analysts recommended a “sell” or some equivalent. National Oilwell Varco accounts for 0.86% of the iShares North American Natural Resources ETF (IGE).

In comparison, ~78% of the analysts tracking Schlumberger (SLB) rated it as a “buy” or some equivalent on February 24. Approximately 20% rated the company as a “hold.” Read Why Did Schlumberger’s 4Q16 Earnings Beat Estimates? to learn about Schlumberger’s 4Q16 earnings guidance.

Analysts’ rating changes

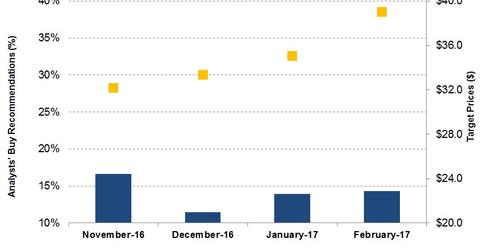

From November 24, 2016, to February 24, 2017, the percentage of analysts recommending a “buy” or some equivalent for National Oilwell Varco fell from 17% to 14%. A year ago, ~17% of the sell-side analysts recommended a “buy” for National Oilwell Varco.

Analysts’ target prices

Wall Street analysts’ mean target price for National Oilwell Varco on February 24 was $39.02. Currently, National Oilwell Varco is trading at ~$39.80. It implies an ~2% downside at its current consensus mean price. A month ago, analysts’ average target price for National Oilwell Varco was $35.1.

Target prices for National Oilwell Varco’s peers

The mean target price, surveyed among the sell-side analysts, for Core Laboratories (CLB) was $123.4 on February 24. Currently, Core Laboratories is trading at ~$114.2. It implies 8% upside at its average target price. The mean target price, surveyed among the sell-side analysts, for TechnipFMC (FTI) is $37.5. Currently, TechnipFMC is trading at ~$32.3. It implies 16% upside at its average price. To learn more, read What Oilfield Services Companies’ Forward Multiples Indicate.

To learn more about the OFS industry, read The Oilfield Equipment and Services Industry: A Primer.